Medical Debt Collection vs. Internal Billing: When Outsourcing May Make Sense

Over 100 million Americans are living with medical debt, according to KFF Health News. That staggering number affects more than patients. It places enormous financial strain on hospitals, private practices, and clinics trying to keep their operations running. Unpaid invoices tie up cash flow, increase administrative stress, and make it harder for providers to focus on delivering quality care.

At some point, every healthcare provider faces a critical decision: should they continue managing collections through internal billing teams, or is it time to bring in a professional medical debt collection partner?

Understanding the differences between these two approaches can help providers protect both their financial stability and their patient relationships.

What is Internal Billing?

Internal billing refers to the process of managing claims, invoicing, and patient follow-up within the healthcare organization itself. Typically, administrative staff or a dedicated billing department handle these responsibilities as part of the revenue cycle.

Advantages of Internal Billing

- Control: Providers retain full oversight of patient communications, billing cycles, and processes.

- Integration: Internal teams can work closely with electronic health records (EHRs) and practice management systems.

- Familiarity: Staff already understand the organization’s culture, policies, and patient needs.

- Consistency: Patients interact with the same staff for both care coordination and billing, creating a smoother experience.

- Customization: Providers can adjust payment plans or discounts directly without involving a third party

- Immediate Access: Billing staff can quickly escalate issues or questions to physicians or administrators.

- Smaller Scale Efficiency: For practices with low patient volumes, internal billing may be more cost-effective than outsourcing.

Drawbacks of Internal Billing

- High Overhead: Running billing in-house requires paying salaries, benefits, and staff training, along with maintaining billing software and systems. These costs can add up quickly, especially for small and mid-sized practices.

- Limited Expertise: Internal staff may lack specialized training in handling denied claims, delinquent accounts, or advanced collection techniques, which can reduce recovery effectiveness.

- Time-Consuming: Billing and collections often pull administrative staff away from their primary duties, like scheduling, intake, or patient support, creating inefficiencies across the practice.

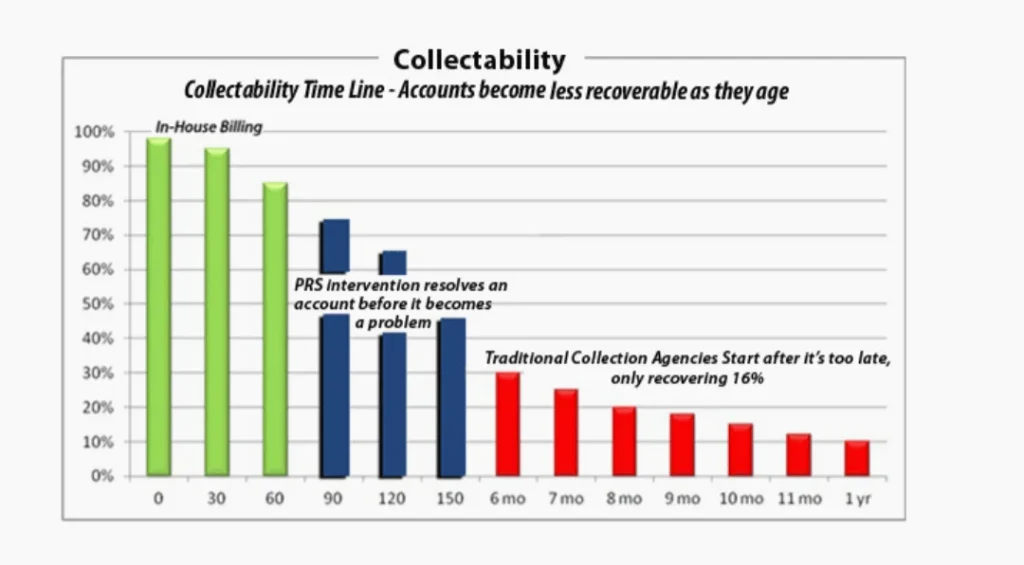

- Lower Recovery Rates: Once accounts age beyond 90 or 120 days, internal teams typically struggle to secure payment, leading to lost revenue that impacts cash flow.

- Compliance Risks: Mistakes in communication or data handling can result in HIPAA breaches or FDCPA violations, exposing the practice to fines and reputational harm.

- Staff Burnout: Balancing collections with daily administrative work can overwhelm staff, leading to frustration, errors, and even higher turnover rates.

- Scalability Challenges: As patient volume increases, the internal billing team may lack the capacity to handle the workload, leading to an increase in errors and longer payment delays.

What Do Professional Medical Debt Collection Agencies Do?

Unlike general billing staff, medical debt collection agencies bring dedicated expertise, specialized tools, and compliance-driven processes to recovering delinquent accounts. Their primary goal is to help providers recover revenue efficiently while preserving patient trust and protecting against legal or reputational risks. Major functions of a medical collection agency include:

Regulatory Compliance

Healthcare collections require strict adherence to HIPAA (for protecting patient data) and FDCPA (for ethical collection practices). Professional agencies are trained to meet these legal requirements, reducing the risk of violations, penalties, or lawsuits for providers.

Advanced Methods and Analytics

Agencies use technology like skip tracing to locate patients who have moved, automated reminders for overdue accounts, and analytics to identify which debts are most collectible. These tools improve recovery rates far beyond what most internal teams can achieve.

Patient-Sensitive Communication

Experienced collectors understand the delicate nature of medical debt. They use respectful, transparent, and empathetic approaches that help preserve the provider-patient relationship, even when financial matters are difficult.

Escalation Capability

When accounts require more formal action, agencies can escalate matters legally or through structured repayment negotiations. This ensures that even hard-to-recover accounts are managed without overwhelming the provider’s staff.

Dedicated Focus on Collections

Unlike in-house teams juggling multiple tasks, agencies focus solely on collections. This specialized attention leads to faster resolution of delinquent accounts and stronger cash flow for the practice.

Custom Payment Options

Many agencies set up tailored payment plans, digital payment portals, or flexible scheduling options for patients. This not only improves the likelihood of payment but also reduces patient frustration.

Detailed Reporting and Transparency

Providers can access recovery reports, account statuses, and collection metrics in real time. This level of visibility helps administrators track performance while still staying hands-off with the day-to-day process.

Industry Expertise

Healthcare-focused agencies understand payer contracts, insurance complexities, and patient billing trends. This niche knowledge allows them to approach collections differently from a generic debt collector.

Medical Debt Collection vs. Internal Billing: A Quick Comparison

| Factor | Internal Billing | Medical Debt Collection Agency |

| Cost | Ongoing salaries, benefits, software, and training. | Low Flat-Fee or Contingency-based. |

| Expertise | General billing knowledge; limited collection training. | Specialized collectors with healthcare compliance expertise. |

| Compliance | Higher risk of HIPAA/FDCPA violations. | Professional adherence to strict laws and regulations. |

| Success Rates | Lower recovery for accounts past 90 days. | Higher recovery rates, especially on aged accounts. |

| Patient Relations | Direct, but can strain staff-patient interactions. | Patient-focused, respectful communication that preserves trust. |

10 Signs to Watch When Deciding on Medical Debt Collection vs. Internal Billing

While internal billing works in some situations, there are many cases where outsourcing to a professional agency is the smarter, more sustainable choice. Here are the top 10 signs it may be time to partner with experts:

- Rising Aging Accounts: A growing portion of accounts receivable are stuck past 90 or 120 days, making them increasingly difficult for internal staff to recover.

- Declining Collection Rates: Patients are paying fewer bills in full or delaying payments, leaving your practice with mounting balances.

- High Claim Denials: Frequent insurance rejections slow down reimbursement and require specialized expertise to appeal and resolve.

- Staff Overload: Front-office or billing staff are spending more time chasing payments than managing scheduling, patient intake, or customer service.

- Cash Flow Strain: Unpaid accounts are creating budget shortfalls, delaying investments in staff, equipment, or practice expansion.

- Compliance Concerns: Fear of HIPAA or FDCPA violations is growing, especially as regulations become stricter and penalties steeper.

- High Turnover and Burnout: Billing teams feel overwhelmed, leading to mistakes, stress, and staff attrition, which only worsens the collection backlog.

- Limited Technology: Without advanced tools like skip tracing, predictive analytics, or automated reminders, internal teams can’t compete with professional agencies’ efficiency.

- Reputation Risks: Patient frustration grows when billing issues aren’t handled quickly or sensitively, potentially damaging the practice’s reputation.

- Inability to Scale: As patient volume increases, in-house billing simply can’t keep up, and the backlog of unpaid claims and accounts balloons out of control.

Recognizing these challenges is essential to deciding between medical debt collection vs. internal billing, and many providers find outsourcing to be a better method to improve cash flow.

Why Is PRS | Professional Receivable Solutions LLC. the Reliable Partner for Your Medical Debt Collection Needs?

Many healthcare providers hesitate to hire a collection agency because of understandable concerns, such as:

- Loss of Control: Worrying that outsourcing means giving up oversight of patient communications and billing decisions.

- Damage to Brand Image: Concern that patients may associate their provider with aggressive or impersonal collection tactics.

- Uncertain Costs: Fear of paying high fees without guaranteed recovery results.

- Aggressive Tactics: Anxiety that some agencies may use harsh methods, risking compliance violations or eroding patient trust.

But when you choose the right partner, outsourcing collections doesn’t mean giving up control. Hiring a debt collection agency means gaining specialized expertise, stronger compliance, and better results without overwhelming your staff.

At Professional Receivable Solutions LLC, we help providers collect more, spend less, and stay in control, all while maintaining a professional, compliant, and respectful approach.

Here’s how partnering with a professional agency like PRS4U transforms your collections process:

Higher Recovery Rates

PRS4U uses a proven, multi-stage process that focuses on early intervention. This strategy consistently outperforms traditional collection methods by resolving accounts faster and improving recovery percentages, especially critical in healthcare, where every day an account ages, the chance of recovery declines.

Reduced Opportunity Cost

Instead of having internal staff spend hours mailing statements or making unanswered calls, PRS4U manages the process efficiently. This frees your team to focus on patient care and operational priorities while revenue flows back into your practice.

Collection Control

With PRS4U, you never lose control. Through our client portal, you can submit, stop, or suspend accounts in real time. You determine the approach, whether it’s a softer, diplomatic touch or a more direct follow-up.

Cost-Effective Pricing

Unlike conventional commission-based agencies, PRS4U provides flat-fee Stage One System (averaging $10 per account) and account-based, predictable pricing at later stages.

Patient-Sensitive Approach

Every interaction is handled with professionalism and empathy, ensuring patients are treated respectfully while protecting your reputation. PRS4U operates with full compliance to HIPAA regulations, safeguarding patient data, and adheres to the Fair Debt Collection Practices Act (FDCPA) for ethical collections. Our healthcare expertise enables us to understand the unique challenges of medical debt collection and balance recovery with compassion, compliance, and care.

Consumer and Commercial Expertise

Beyond patient billing, PRS4U also manages commercial accounts, providing a comprehensive solution for practices with diverse receivable needs.

When managed by the right partner, outsourcing collections provides higher recovery, reduces strain on your internal resources, and lowers compliance risks, all while preserving patient relationships.

With PRS4U, you don’t have to choose between maintaining your reputation and strengthening your bottom line. You get both.

Recover More, and Put Patients First with PRS | Professional Recovery Solutions

At Professional Receivable Solutions, we understand that collections should strengthen your practice, not strain it. Our healthcare-focused process improves recovery rates, eases the burden on your staff, and protects the trust you’ve built with patients.

If aging accounts and mounting balances are slowing down your cash flow, PRS4U can help you streamline collections and regain control.

See how much more you can recover, without compromising care, compliance, or your brand.