Why Are Appeals in Medical Billing Essential for Financial Stability?

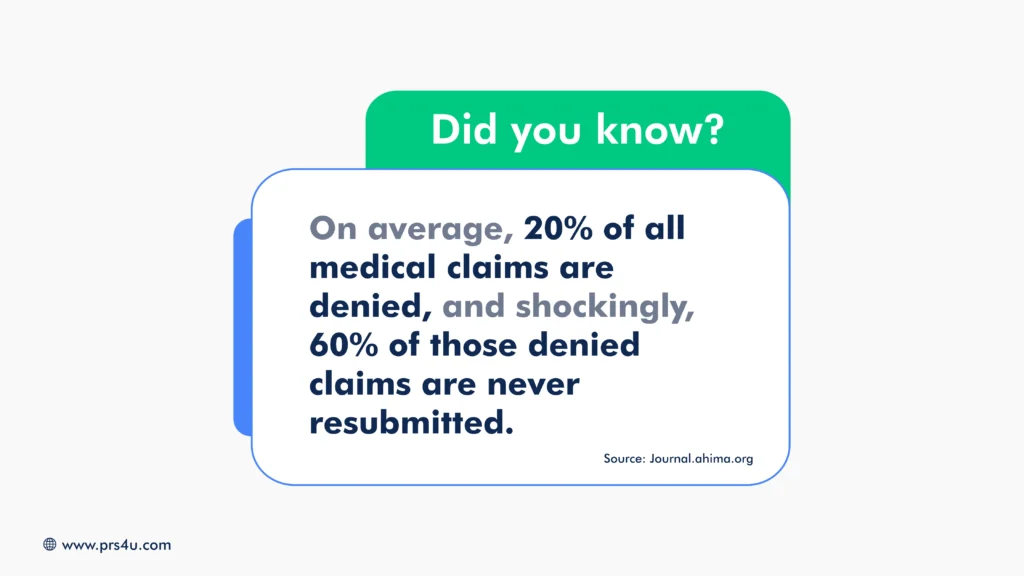

Medical billing is one of the most important yet challenging parts of running a healthcare practice. Even when claims are submitted carefully, providers often find themselves dealing with denials. Industry data shows that nearly 15% of all medical claims are initially denied, and each one represents lost or delayed revenue. Multiply that across hundreds of claims a month, and the financial impact becomes significant.

Appeals in medical billing are the formal pathway providers have to contest denials and recover what they are owed. Without an effective appeals process, practices risk leaving thousands of dollars uncollected, straining cash flow, and even damaging relationships with patients who are caught in the middle of insurance disputes.

For medical providers, understanding appeals in billing, what they are, why they matter, and how to manage them, is essential for long-term financial stability.

What Are Appeals in Medical Billing?

| An appeal in medical billing is a formal request by a healthcare provider to an insurance company, asking them to reconsider a denied or underpaid claim. When payers reject claims, providers have both the legal and contractual right to challenge those decisions. Appeals ensure that care already delivered is properly and fairly compensated. |

Main Types of Appeals

Appeals vary in complexity depending on the nature of the denial and the payer’s process. The main types include:

- Pre-Service/Pre-Authorization Appeal: Filed before a patient receives care, usually when an insurer refuses to authorize a procedure or treatment.

- Post-Service Appeal: Filed after the patient has already received treatment but the insurer denies or underpays the claim.

- Urgent Care/Expedited Appeal: Used when treatment is medically necessary and delays could put the patient’s health at risk. These require a faster decision from the insurer.

- Marketplace Plan Appeal: Specific to plans obtained through state or federal health exchanges, where providers or patients can challenge coverage decisions.

- Internal Appeal: Submitted directly to the insurance company, asking them to review and reconsider their own denial.

- External Appeal: Escalated to an independent review organization when internal appeals fail, offering an unbiased evaluation.

Levels of Appeals

Most appeals also follow a tiered structure:

- First-Level Appeal: Reviewed by the insurer’s claims department.

- Second-Level Appeal: Reviewed by a medical director or another senior reviewer not involved in the original denial.

- Third-Level Appeal: External review by an independent authority with final say.

Types of Appeal Outcomes

Not every appeal has the same result. Providers should be prepared for several possible outcomes when challenging denied claims:

-

- Approval in Full: The payer overturns the denial and reimburses the claim as originally submitted.

- Partial Approval: The claim is approved but at a reduced amount, often due to coverage limits, coding adjustments, or payer policies.

- Denial Upheld: The insurer maintains the original denial. At this point, providers may consider higher-level or external appeals if available.

- Administrative Closure: Appeals can be dismissed if deadlines are missed, documentation is incomplete, or payer requirements are not met.

Understanding these outcomes helps providers set realistic expectations and determine when to persist versus when to move on.

Why Do Appeals Matter for Medical Practitioners?

Appeals protect a practice’s financial health, patient relationships, and overall operations. Without them, providers risk losing revenue and credibility.

Protecting Revenue

Every denied claim left unchallenged is lost income for services already provided.

Appeals give providers a second chance to recover payments that would otherwise be written off.

Improving Compliance and Accuracy

Appeals highlight recurring issues in coding, documentation, or authorizations. Reviewing them strengthens billing practices and reduces future denials.

Safeguarding Patient Trust

Denied claims often leave patients with confusing or unexpected bills. Proactive appeals protect patients from undue financial stress and maintain their confidence in the provider.

Driving Operational Accountability

Appeals expose systemic issues, such as repeated coding errors or shifting payer policies. Addressing these patterns builds a healthier revenue cycle over the long term.

Supporting Cash Flow Stability

Appeals help providers maintain steady cash flow by reducing the number of claims written off. This stability allows practices to invest in staff, technology, and patient care without financial interruptions.

Common Reasons Claims Are Denied

Below are a few reasons why claims can be denied:

-

- Coding Errors: Incorrect or outdated ICD-10/CPT codes, wrong modifiers, or mismatched diagnoses and procedures often trigger denials.

- Eligibility Issues: Claims may be denied when the patient’s insurance is inactive, coverage has lapsed, or the provider is out-of-network. Errors in patient eligibility and registration are cited as the top causes of denials by revenue cycle leaders.

- Missing Documentation: Insurers frequently require proof of medical necessity, clinical notes, or detailed charts. When documentation is incomplete or missing, claims are routinely rejected.

-

- Duplicate Claims: Resubmitting the same service or claim (even with the intent of a correction) can lead to automatic denial under duplicate-claim rules.

- Authorization Problems: Many services, especially complex procedures, require pre-authorization. If prior approval is not secured or documented, the claim is often denied.

- Payer Policy Changes: Each insurer’s rules change. Policies about covered services, billing codes, or documentation requirements vary and change over time, so a claim accepted last year might be denied now.

The Appeals Process: Step by Step

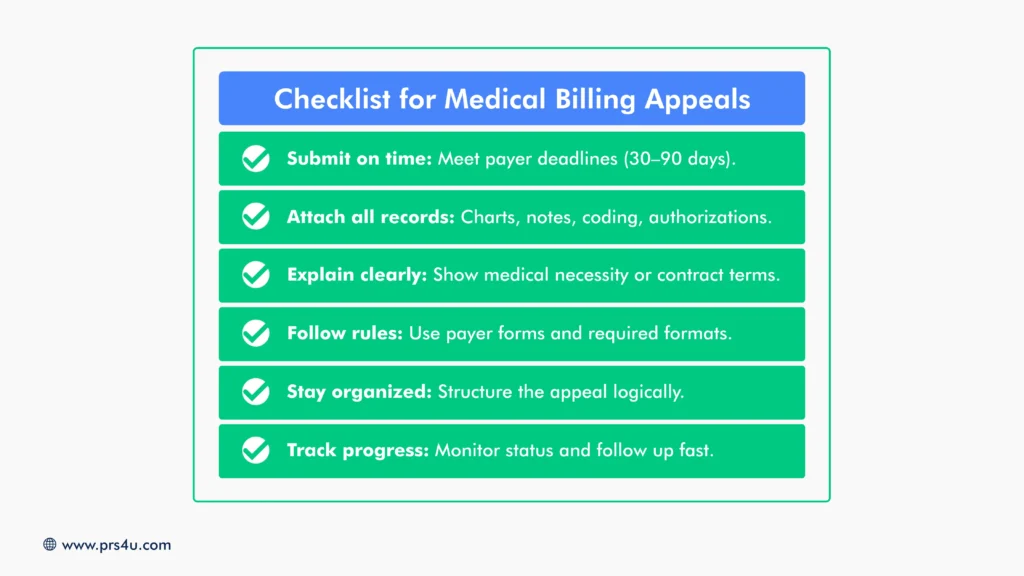

On the surface, appealing a denied claim seems straightforward. But in reality, the process is time-sensitive, documentation-heavy, and varies by payer. For providers, this creates an administrative burden that pulls staff away from patient care.

Here’s what an appeal process looks like:

- Identify the Denial: Providers must carefully review the Explanation of Benefits (EOB) or remittance advice to confirm the reason for rejection.

- Gather Documentation: Charts, clinical notes, coding references, and authorizations must be pulled together to justify the claim.

- Prepare and Submit the Appeal: An appeal letter must be drafted with clear arguments, supported by payer guidelines and clinical evidence, and submitted within strict deadlines.

- Track and Follow Up: Staff must monitor appeal status, respond to additional payer requests, and chase delayed responses.

- Escalate if Needed: If the initial appeal fails, the case often moves to higher-level or external reviews, adding more time and complexity.

For many practices, this process ties up staff, delays revenue, and increases the risk of missed deadlines, which means permanent revenue loss.

Challenges Providers Face with Appeals

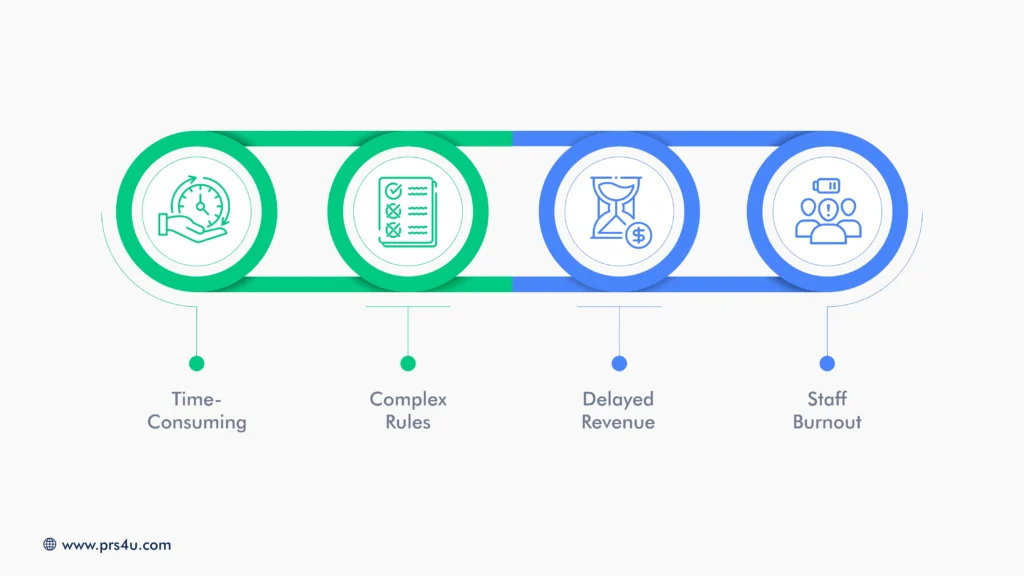

The challenges listed below highlight why appeals can’t be managed casually. They require persistence, expertise, and dedicated resources, more than many in-house teams can realistically sustain.

Time-Consuming: Appeals require hours of administrative work, reviewing EOBs, gathering medical records, drafting letters, and following up with insurers. Every hour spent on appeals is an hour pulled away from patient scheduling, care coordination, or front-office operations.

Complex Rules: No two insurers follow the same process. Each has unique forms, submission channels, and timelines. Staff must juggle multiple sets of requirements, increasing the risk of mistakes and missed deadlines.

Delayed Revenue: While appeals are pending, payment is withheld, sometimes for weeks or months. This creates cash flow gaps that make it harder for providers to cover payroll, overhead, and investments in patient care.

Staff Burnout: Billing teams already manage claims, eligibility checks, and patient questions. Adding appeals on top of that workload leaves staff stretched thin, increasing stress, errors, and even turnover.

When Appeals Aren’t Enough: How PRS | Professional Receivable Solutions LLC. Helps Recover Lost Revenue

Even with the best denial management strategies, not every claim can be overturned through appeals. Some insurers stand by their denials, and in other cases, balances shift from payer responsibility to patient responsibility. When that happens, unpaid accounts quickly become aged receivables that threaten cash flow.

This is where Professional Receivable Solutions steps in. We are a dedicated medical debt collection partner. Our role begins when appeals end, helping providers recover patient balances efficiently and respectfully.

Here’s how PRS4U supports practices facing post-appeal revenue loss:

- Early Intervention: Acting on delinquent accounts before they age out and become unrecoverable.

- Flat-Rate Pricing: A predictable flat-fee Stage One System (averaging $10 per account) that makes collections cost-effective.

- Full Transparency: A client portal that allows providers to submit, pause, or monitor accounts in real time.

- Compliance and Sensitivity: Adhering to HIPAA and FDCPA standards while treating patients with professionalism and empathy.

By partnering with PRS4U, providers can focus on patient care, knowing there’s a reliable system in place to recover revenue when appeals aren’t enough.

Recover More Beyond Appeals with PRS | Professional Recovery Solutions

Appeals are a critical part of protecting revenue, but they’re not the final safeguard. When denied claims turn into unpaid balances, PRS4U ensures your practice doesn’t write them off. With proven recovery methods, compliance-driven processes, and a patient-first approach, PRS4U helps you secure what you’ve earned without sacrificing reputation or relationships.

Get your free A/R analysis today and protect your practice by reducing revenue loss and ensuring consistent recovery of unpaid balances.