Accounts Receivable Subsidiary Ledger: What Is It and How to Use It?

Delayed payments continue to derail small and mid-sized businesses globally.

An accounts receivable (AR) subsidiary ledger solves this by tracking individual customer transactions and payment behavior, information that a general ledger summarizes but cannot detail. Implementing and maintaining a correctly structured AR subledger empowers better credit decisions, faster reconciliation, and more effective collections.

In this blog, we’ll discuss what an AR subledger is and how it differs from a general ledger, why businesses of all sizes need one, how to set up the ledger, and the common mistakes that businesses should avoid.

What Is an Accounts Receivable Subsidiary Ledger?

An accounts receivable subsidiary ledger is a detailed ledger that tracks every credit-based transaction with individual customers. Unlike your general ledger, which only shows a total accounts receivable (AR) balance, this subledger breaks that number down by customer.

Each entry in the AR subledger includes:

- Customer name or ID

- Invoice number and date

- Credit terms and due dates

- Payment received, and the remaining balance

- Notes on communication or disputes (optional)

Instead of sorting through countless invoices or emails to understand a single customer’s payment history, everything lives in one place. This makes it easier to answer questions like:

- Which clients consistently pay late?

- How much does Customer X still owe?

- Have we followed up on Invoice #12345 yet?

The AR subledger acts as a supporting record for the general ledger’s AR control account. When set up correctly, the total of all balances in the AR subledger should always match the AR amount recorded in the general ledger. This keeps your books clean and makes audits, reconciliations, and forecasting far less painful.

In short, the subsidiary ledger is about gaining visibility, control, and confidence in your receivables.

Accounts Receivable Subsidiary Ledger vs. General Ledger

At first glance, the general ledger (GL) and the accounts receivable (AR) subsidiary ledger cover the same ground, but they serve very different roles in your accounting system.

The general ledger provides a summary view. It shows the total amount your business is owed across all customers, consolidated into a single balance under the accounts receivable control account. This helps create financial statements and provides insight into your company’s overall economic health.

The AR subsidiary ledger, on the other hand, offers a detailed breakdown. It tracks each customer’s activity, what they bought, how much they owe, when they paid, and how much is overdue. This is critical for credit control, follow-ups, and collection strategies.

| Feature | AR Subsidiary Ledger | General Ledger |

| Level of Detail | Tracks transactions for each customer | Summarizes total receivables |

| Use Case | Day-to-day credit management | Financial reporting and oversight |

| Tracking | Invoice-level detail, payment history | High-level receivables balance |

| Reconciliation | Used to reconcile with control account | Hosts the control account balance |

| Visibility | Shows who owes what, and why | Shows how much is owed overall |

Together, these ledgers create a system of checks and balances. The general ledger shows the “big picture,” while the subsidiary ledger fills in all the customer-level details. The two should always be aligned. If the total in your AR subledger doesn’t match the AR balance in your general ledger, it’s a red flag, usually a sign of missed entries, duplicate invoices, or payment posting errors.

Importance of Accounts Receivable Subsidiary Ledger for Businesses

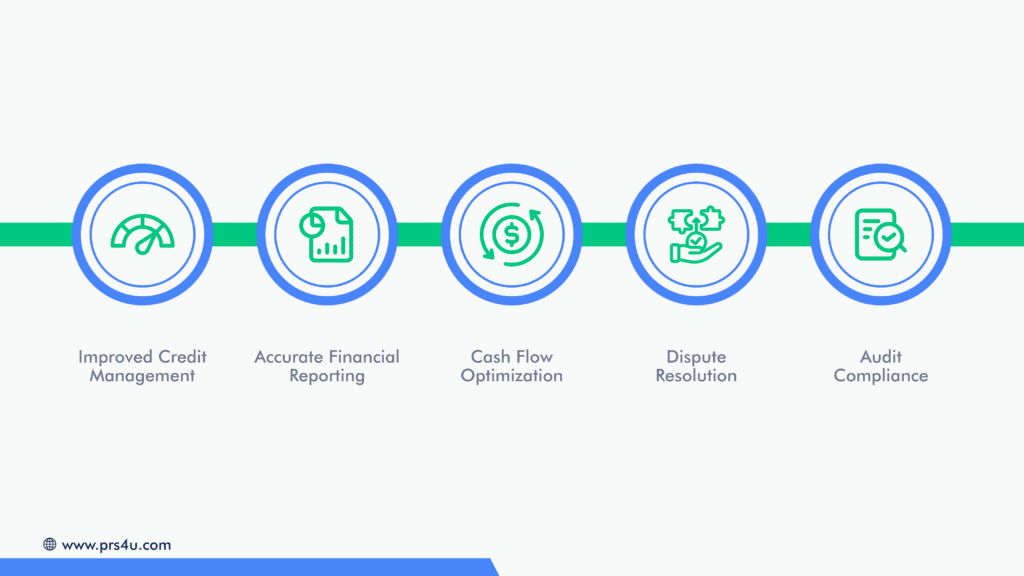

The accounts receivable subsidiary ledger plays a vital role for businesses of all sizes and industries. Its detailed tracking of individual customer transactions and balances offers several benefits that impact financial accuracy, cash flow management, and credit control.

- Improved Credit Management: Detailed customer information helps you evaluate payment behavior and set appropriate credit limits, reducing the risk of late or missed payments.

- Accurate Financial Reporting: Regular reconciliation between the subsidiary ledger and the general ledger ensures that your financial statements are reliable and error-free.

- Cash Flow Optimization: Knowing exactly which customers owe what and when enables targeted collections, accelerates cash inflow, and reduces days sales outstanding (DSO).

- Dispute Resolution: Maintaining a clear, invoice-level record enables the prompt and professional resolution of payment disputes, thereby preserving customer relationships.

- Audit Compliance: A well-maintained subledger provides a comprehensive audit trail, making regulatory reviews and audits smoother and less stressful.

Without an AR subsidiary ledger, businesses risk losing granular visibility into their receivables. This gap can lead to poor credit decisions, delayed payments, inaccurate records, and ultimately, weakened financial health.

Setting Up and Managing an Accounts Receivable Subsidiary Ledger

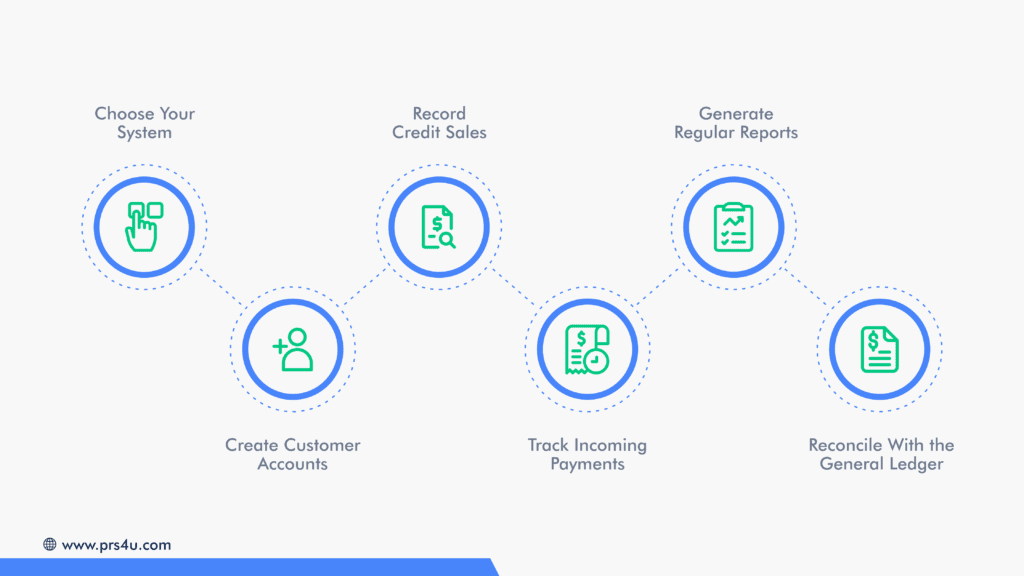

Implementing an effective accounts receivable subsidiary ledger involves transparent processes and consistent management. You can use accounting software or a manual system, but following a structured set of steps will ensure accuracy and usefulness.

- Choose Your System: Decide on accounting software tailored to your business size and complexity, or opt for a well-organized manual system using spreadsheets.

- Create Customer Accounts: Set up accounts for each customer, including contact details, credit terms, and payment history. This forms the foundation for tracking all transactions.

- Record Credit Sales: Every time you make a sale on credit, log the invoice number, sale date, amount, and due date in the customer’s account.

- Track Incoming Payments: As payments arrive, record the amounts and dates, adjusting the customer’s balance accordingly to maintain real-time accuracy.

- Generate Regular Reports: Use reports to monitor outstanding balances, overdue invoices, and payment trends. This insight supports proactive credit and collection decisions.

- Reconcile With the General Ledger: Periodically compare the total balances in the subsidiary ledger with the accounts receivable control account in the general ledger to identify and resolve discrepancies.

Best Practices for Managing Your AR Subsidiary Ledger

|

Reconciling the Accounts Receivable Subsidiary Ledger with the General Ledger

Maintaining accuracy between your accounts receivable subsidiary ledger and the general ledger is essential for financial integrity. While the subsidiary ledger tracks individual customer balances, the general ledger houses the summary control account. These two must always align.

Importance of Reconciliation

Regular reconciliation helps detect and resolve discrepancies early. This protects the accuracy of your financial statements, supports compliance during audits, and builds confidence in your accounting data. Without it, even small errors can snowball into larger reporting and cash flow issues.

Step-by-Step Reconciliation Process

Start with the Subsidiary Ledger: List and total all individual customer balances. This sum represents your detailed accounts receivable.

Compare with the General Ledger: Locate the balance in the accounts receivable control account within your general ledger. These totals should match exactly.

Investigate Any Differences: If the balances don’t align, review recent transactions for issues such as missed or duplicate entries, payment timing differences, data entry errors or unrecorded adjustments.

Correct and Document: Make necessary corrections promptly and document all adjustments. Keeping a record supports future audits and internal reviews.

Common Pitfalls in AR Subledger Management and How to Avoid Them

Even with solid systems in place, many businesses struggle to maintain accurate and aligned accounts receivable subledgers. The most common challenges include:

- Delayed or Inconsistent Data Entry: Late or irregular updates to invoices or payments lead to mismatched balances and reconciliation errors. Standardized processes and automation help maintain data accuracy and integrity.

- Irregular Reconciliation: Failing to perform timely reconciliations between the subledger and general ledger can allow minor discrepancies to grow. Scheduled checks ensure records stay aligned.

- Weak Credit Monitoring: Without regular review of ageing reports, businesses may extend too much credit or overlook delinquent accounts. Routine monitoring supports better decisions.

- Lack of an Audit Trail: Poor system configuration or manual entries obscure accountability. A clear audit trail ensures transparency and supports compliance.

- Unclear Role Assignment: When no one is responsible for AR updates or reconciliation, critical tasks are often missed. Defined responsibilities improve accuracy and efficiency.

Professional Receivable Solutions LLC collaborates closely with your internal team to prevent these issues from escalating. From early intervention and real-time reporting to client-controlled workflows and cost-effective collections, PRS4U strengthens your AR process without burdening your staff.

Make AR Management Smarter with Professional Receivable Solutions LLC.

Professional Receivable Solutions (PRS) understands that maintaining accuracy in your subledger is just part of effective revenue management. Collections also play a major role. Here’s how PRS steps in to streamline your process and strengthen your bottom line:

- Flat‑Fee Stage One Collections: PRS begins with a written demand at a predictable fee averaging $10 per account (based on volume), helping recover funds early without surprises.

- Diplomatic Verbal Outreach: Our trained team follows up verbally, striking the right tone to preserve customer relationships while securing payments.

- Attorney Suit Initiation: For eligible accounts, PRS moves to Stage Three with attorney-supported suit options, only by client approval.

- Real-Time 24/7 Access: A secure client portal lets you submit, pause, or stop accounts instantly and track collection progress in real-time.

- Commercial & Consumer Expertise: Whether you’re managing B2B invoices or patient balances, PRS adapts strategies to fit each situation.

Turn your detailed accounts receivable subledger into actionable revenue. Instead of letting aging accounts clog your cash flow or financial clarity, let PRS step in with strategic, compliant, and transparent collections.

Request your free A/R analysis today and partner with PRS to make your receivables truly work for you.