B2B Collections Strategies That Help You Recover Revenue Faster

81% of businesses are facing a surge in overdue invoices. Half are dealing with late-paying customers. And 77% of accounts receivable teams are failing to meet their collection targets, falling behind on their cash flow, and operational efficiency.

These disruptions can stall growth, strain resources, and create tension with clients. For teams already stretched thin, chasing unpaid invoices becomes a time-consuming burden that diverts focus from strategic priorities.

As a business, you don’t want to be part of these numbers. So what can you do?

Implementing structured business-to-business collections practices can turn the tide. By streamlining processes, improving follow-ups, and utilizing proven methods, businesses can recover outstanding revenue faster while maintaining strong client relationships.

B2B Debt Collection Mistakes to Avoid in 2025

Chasing unpaid invoices can be challenging. Even small missteps in B2B debt collection can damage client relationships, slow cash flow, and waste your team’s time.

Common B2B Debt Collection Mistakes

- Neglecting Early Follow-Ups: Waiting too long to remind clients often turns manageable debts into significant write-offs.

- Generic Communication: Using one-size-fits-all emails or calls can alienate clients instead of encouraging payment.

- Ignoring Documentation: A lack of detailed invoices or signed contracts makes recovery more difficult and disputes more likely.

- Overlooking Internal Coordination: Disjointed communication between sales, finance, and accounts receivable leads to confusion and delays.

- Skipping Compliance Checks: Failing to follow regulations can lead to legal exposure and damage your business reputation.

- Failing to Track KPIs: Without monitoring overdue accounts and collection performance, patterns of late payment go unnoticed.

Avoiding these mistakes sets the foundation for more substantial cash flow, better client relationships, and a more efficient collections process. By being proactive, methodical, and compliant, businesses can reclaim revenue more quickly while maintaining trust with their clients.

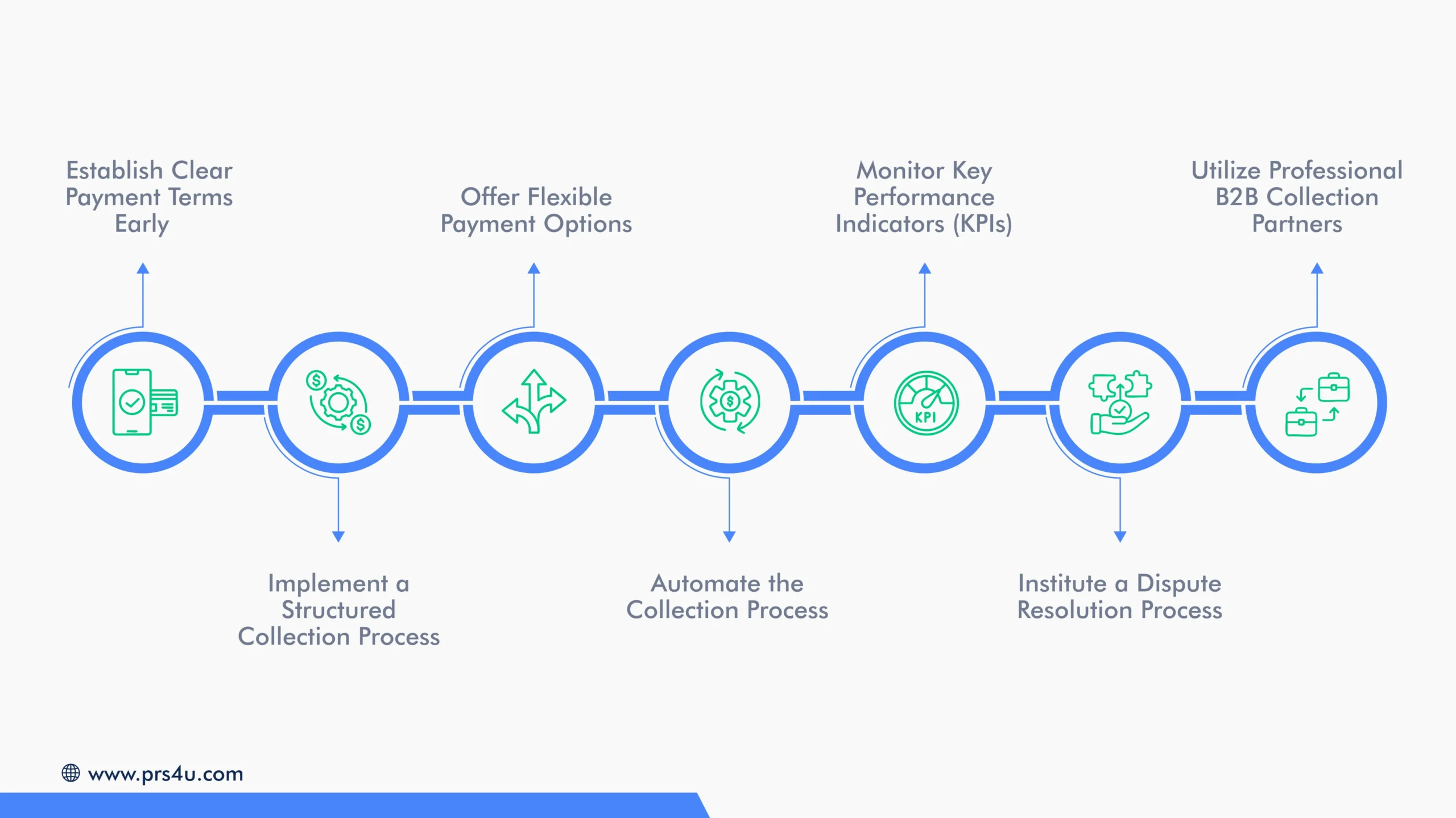

7 Best Practices to Fast Track Business-to-Business Collections

With common pitfalls out of the way, the next step is knowing what works. Implementing proven best practices can accelerate B2B collections, reduce late payments, and improve cash flow without straining client relationships. Here are seven strategies to accelerate your business-to-business collections.

1. Establish Clear Payment Terms Early

Many B2B payment delays stem from misunderstandings about deadlines or expectations. Setting clear payment terms at the outset of a client relationship helps prevent confusion and fosters accountability. Outline the following details in your contracts and invoices:

- Exact payment due dates and frequency (e.g., net 30, net 60)

- Accepted payment methods (ACH, wire transfer, credit card, etc.)

- Penalties or interest are applied to late payments

Communicating these terms clearly and consistently helps clients understand their obligations, reducing the risk of overdue invoices. Reinforce them during onboarding, in welcome emails, and in invoice reminders.

A transparent framework signals professionalism, encourages timely payments, and makes later collections far less contentious. It’s also one of the simplest ways to improve cash flow for small businesses, ensuring your team spends more time driving growth than chasing unsettled balances.

2. Implement a Structured Collection Process

A reactive approach to overdue invoices often leads to delayed payments and strained client relationships. Implementing a structured collection process ensures that every account is managed consistently and efficiently, reducing uncertainty for both your team and your clients. Consider these components:

- Multi-Channel Communication: Use emails, phone calls, and formal letters to follow up on outstanding invoices.

- Escalation Procedures: Implement a tiered system that begins with polite reminders and progresses to more stringent measures, including legal action as a last resort.

- Documentation: Maintain detailed records of all communications, follow-ups, and actions to create a transparent history for reference or dispute resolution.

By following a systematic approach, your team can maintain professionalism, protect client relationships, and improve cash flow without leaving payments to chance. Structured processes also make it easier to track performance and adjust strategies when needed.

3. Offer Flexible Payment Options

Many B2B clients face their own cash flow fluctuations, seasonal demands, or unexpected expenses, which can make meeting strict payment deadlines challenging. By introducing flexible payment options, your business can accommodate these variations without sacrificing revenue.

Options include online payments, installment plans, early-payment incentives, or credit card processing. Providing choices makes it easier for clients to pay promptly while maintaining goodwill.

Flexible payment methods also signal that your company is understanding and professional. When clients feel supported rather than pressured, they are more likely to prioritize your invoices over others. This reduces delays and minimizes the risk of disputes, helping your accounts receivable remain predictable and manageable.

Ultimately, offering adaptable payment options benefits both parties: your business collects revenue more quickly, and clients experience a smoother, more seamless transaction process. In today’s B2B environment, this approach strengthens relationships, encourages timely payments, and improves overall cash flow stability.

4. Automate the Collection Process

Manual tracking of overdue invoices, follow-ups, and reminders can quickly become overwhelming, especially as your client base grows. Automating parts of the collection process ensures that no account is overlooked and that follow-ups happen consistently and on time.

Automation can include scheduled emails, SMS reminders, and system-generated alerts to notify your team of past-due accounts, reducing human error and saving valuable administrative time. It also allows your team to focus on higher-value tasks rather than repetitive, manual processes.

| Aspect | Manual Process | Automated Process |

| Follow-ups | Staff must remember to send reminders | Emails/SMS scheduled automatically |

| Tracking overdue accounts | Spreadsheets, prone to human error | System alerts & dashboards |

| Time investment | High—repetitive admin work | Low—team focuses on strategic tasks |

| Insights | Delayed, often reactive | Real-time reporting & payment trends |

| Client experience | Inconsistent communication | Timely, professional, consistent |

When paired with reporting dashboards, automation provides instant insights into outstanding payments, aging reports, and client payment trends. This transparency helps you identify accounts that need immediate attention, making the overall process more efficient.

5. Monitor Key Performance Indicators (KPIs)

Tracking the right KPIs is crucial for understanding the effectiveness of your B2B collections process. Monitoring these metrics provides actionable insights, enabling you to identify bottlenecks, adjust strategies, and enhance overall cash flow. Without clear KPIs, it’s easy for overdue accounts to slip through the cracks or for your team to spend time on tactics that don’t yield results.

Essential KPIs to monitor include:

- Days Sales Outstanding (DSO): Measures the average number of days it takes to collect payments after issuing invoices.

- Collection Effectiveness Index (CEI): Tracks the efficiency of your collection efforts in recovering outstanding balances.

- Promise-to-Pay Follow-Through: Percentage of clients who honor agreed-upon payment dates.

- Aging of Receivables: Identifies the duration of outstanding invoices, highlighting priority accounts.

- Recovery Rate: Measures the proportion of outstanding invoices successfully collected over a period.

Regularly reviewing these metrics allows your team to act proactively, optimize workflows, and refine collection strategies. It also ensures accountability and provides a clear view of the financial health of your accounts receivable operations.

6. Institute a Dispute Resolution Process

Unresolved disputes are a significant reason B2B invoices remain unpaid. Establishing a formal dispute resolution process helps prevent delays, ensures transparency, and maintains healthy client relationships. When a client raises an issue, having a structured approach can transform potential friction into a straightforward, manageable workflow.

A strong dispute resolution process typically includes:

- Prompt Acknowledgment: Respond immediately when a client questions an invoice or raises concerns.

- Documentation Review: Examine contracts, invoices, and communication records to assess the legitimacy of the dispute.

- Collaborative Resolution: Work directly with the client to clarify misunderstandings and negotiate adjustments if necessary.

- Escalation Protocol: Define the process for escalating disputes to management or legal support for resolution.

- Follow-up Tracking: Ensure that all resolved disputes are correctly documented and closed to prevent recurrence.

By proactively managing disputes, businesses can reduce payment delays, preserve client trust, and maintain consistent cash flow, turning potential obstacles into opportunities for stronger relationships.

7. Utilize Professional B2B Collection Partners

Outsourcing overdue invoice recovery to a professional collection partner can significantly improve cash flow while reducing strain on your internal team. Experienced B2B collection agencies bring specialized expertise, legal knowledge, and proven strategies that many in-house accounts receivable teams may not possess.

A professional partner helps by:

- Maximizing Recovery Rates: Skilled collectors utilize proven methods to efficiently recover debts.

- Protecting Client Relationships: Agencies communicate firmly yet professionally, preserving ongoing business partnerships.

- Ensuring Compliance: Collection experts navigate complex regulations, reducing the risk of legal issues.

- Saving Time and Resources: Outsourcing frees your team to focus on core operations rather than chasing overdue payments.

Outsourcing delivers a structured, compliant, and results-driven process. That’s where Professional Receivable Solutions (PRS) comes in. If you’re evaluating how to hire a debt collection agency and maximize recovery results, PRS offers a proven model: multi-stage strategies, transparent pricing, and a respectful approach that safeguards client relationships.

| Aspect | In-House Collections | With PRS |

| Recovery Rates | Limited by staff capacity and experience | Higher recovery with multi-stage, proven strategies |

| Client Relationships | Risk of strained communication | Professional, diplomatic outreach that preserves trust |

| Compliance | Potential gaps in legal/regulatory knowledge | Experts ensure compliance, reducing legal risk |

| Resources & Time | Staff hours drained chasing payments | Your team focuses on core business priorities |

| Cost Efficiency | Hidden costs from inefficiency | Flat $10/account Stage-1 pricing, account-based predictable pricing at later stages |

Struggling with Overdue B2B Invoices? Let PRS Help.

Stop allowing unpaid invoices to disrupt your cash flow and drain your team’s time. With Professional Receivable Solutions (PRS), you get a proven B2B collections partner that recovers outstanding balances while protecting your client relationships.

- Maximize Recovery: Stage One written demand, Stage Two verbal communication, and Stage Three Optional Suit Initiation work together to recover more revenue than standard methods.

- Save Time and Resources: Reduce the burden on your team by letting PRS handle the entire collections process, from reminders to escalation, professionally and efficiently.

- Transparent, Predictable Outcomes: Flat-fee Stage One collections and detailed reporting allow you to track progress and maintain full visibility.

- Real-Time 24/7 Access: A secure client portal lets you manage accounts instantly and track collection progress in real-time.

- Protect Client Relationships: Every interaction is handled diplomatically, ensuring your business reputation remains intact.

- Boost Your Bottom Line: With a proven 3x higher recovery rate than competitors, PRS turns overdue accounts into cash flow.

Start today with a free B2B accounts receivable analysis and see how PRS can help you accelerate collections, cut bad debt, and keep your business financially strong.

Request free A/R analysis today to regain control of your overdue accounts and turn outstanding payments into reliable cash flow.