Best 8 Practices for Collecting Patient Balances Without Compromising Relations With Them

Most healthcare professionals didn’t enter the medical field to chase payments. However, with rising deductibles, increased out-of-pocket costs, and growing patient financial responsibility, collecting balances has become one of the most challenging aspects of running a practice.

You send reminders. You wait. You hesitate to follow up too strongly, prioritizing the patient relationship over payment collection.

A recent survey found that 56% of patients would consider switching providers due to poor billing experiences, even when the care itself met their expectations.

The following eight strategies provide a framework for optimizing patient balance collections while maintaining strong, positive patient relationships.

How Can You Make Paying Easier for Patients?

It’s essential to understand why patients fall behind in clearing balances respectfully and effectively. In many cases, it’s not a matter of unwillingness, but relatively financial stress, confusion, or emotional discomfort. Recognizing these reasons helps you respond with empathy and clarity.

1. Ease Financial Responsibility Burden

With high-deductible plans on the rise, even insured patients are struggling to afford their healthcare costs.

That unexpected burden can cause them to delay or avoid payment altogether, especially if they’re juggling other household bills.

2. Fix Billing Confusion Fast

It’s not uncommon for a patient to receive a bill and have no idea what they’re being charged for, or why the amount differs from what they expected. Maybe their insurance was applied differently than they thought. Perhaps an additional code was added for a secondary service. Maybe they already paid a co-pay and assume they’re done.

To them, it feels confusing and possibly even unfair. But rather than calling to ask questions (which they may feel ill-equipped to do), many patients simply set the bill aside. This “I’ll deal with it later” mindset can persist for months, resulting in aged accounts that are much harder to recover.

The truth is, most patients aren’t trying to avoid payment; they’re trying to avoid the discomfort of navigating a system they don’t understand.

3. Set Clear Cost Expectations

One of the most avoidable reasons for non-payment is simply this: the financial expectations were never clearly discussed.

Many practices focus heavily on clinical care (as they should), but don’t consistently explain costs ahead of time. Without upfront clarity, via printed policies, face-to-face conversations, or portal-based cost estimates, patients often assume their visit is fully covered.

When the bill arrives later, it feels unexpected. Not just because of the cost, but because it contradicts their expectations. This gap between what they assumed and what they’re now being asked to pay can create frustration and mistrust, even when the charges are accurate.

Establishing financial transparency early can dramatically reduce these misunderstandings and the resistance they create.

4. Offer Convenient Payment Options

If the only option is to pay in full, by cheque, within 10 days, that might feel unrealistic to someone already juggling rent, food, and other obligations. While 75% of patients prefer online payment methods, many providers still rely on outdated manual systems. Without user-friendly portals, payment plans, or reminder tools, patients may default simply because the process is too inconvenient.

Top 8 Tips To Collect Patient Balances Without Compromising Relations

You don’t have to choose between collecting what your practice is owed and maintaining the trust you’ve built with your patients. When you lead with clarity, consistency, and compassion, you create a patient billing experience that feels less transactional and more respectful. Here are eight practical tips to help you learn how to collect medical debt without sacrificing relationships along the way.

1. Provide Financial Transparency

Patients appreciate honesty and clarity, especially when it comes to money. From the very first interaction, ensure that your financial policies are communicated. This includes explaining what services are covered by insurance, the patient’s responsibility, and any available payment options.

Providing upfront cost estimates or easy-to-understand statements helps set expectations and reduces confusion later. When patients know what to expect, they’re more likely to pay on time and feel respected in the process. Transparency is essential for collecting patient balances.

2. Pre-Discharge Payment Setup

One of the most effective ways to avoid confusion or delays is to discuss and confirm payment expectations with the patient before they leave your office. This proactive conversation sets a clear understanding and reduces surprises when the bill arrives.

Whether it’s a co-pay, an estimated balance, or a payment plan option, having patients acknowledge their financial responsibility early builds trust and accountability. It also allows them to ask questions and express any concerns in a supportive environment.

By establishing payment terms upfront, your practice creates a foundation for smoother patient debt collection and a better patient experience, because no one likes surprises when it comes to money.

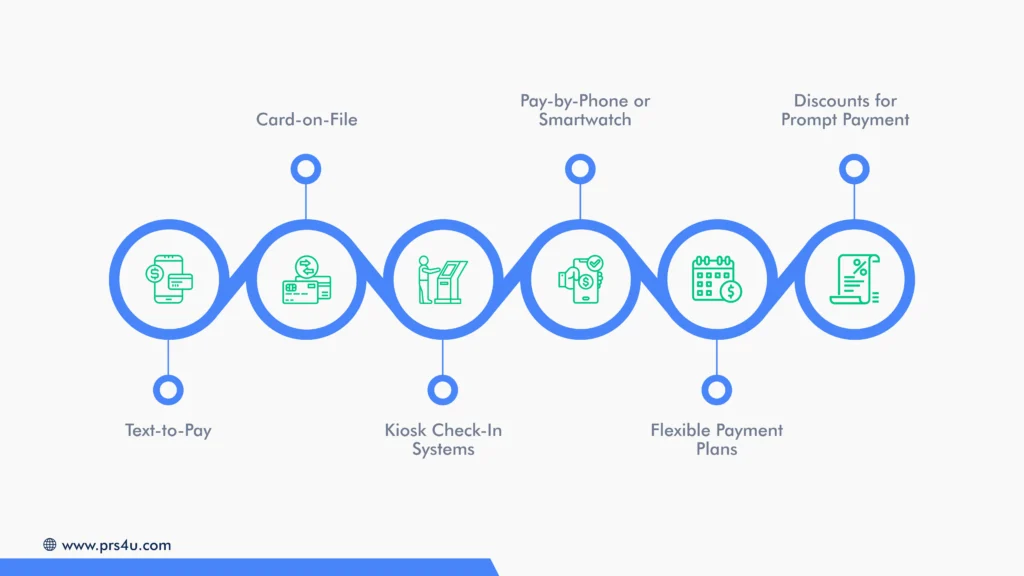

3. Make Payments Simple

Making it easy for patients to pay goes a long way toward timely patient debt collections. A complex or outdated payment process can be a significant barrier, even for patients who want to settle their balances promptly.

Some practical methods to consider include:

Text-to-Pay: Sending payment reminders and invoices directly to patients’ mobile phones via text message simplifies the process. Patients can access their accounts and make payments with just a few taps; no usernames or passwords required. This instant, low-friction method significantly boosts response rates.

Card-on-File: Securely storing patient payment details allows for a quick and automatic medical billing process. While this streamlines transactions for both your staff and patients, be mindful of any associated processing fees and ensure compliance with data security standards.

Kiosk Check-In Systems: By enabling patients to handle check-in and payment tasks independently through kiosks, these systems reduce administrative workload and enhance patient convenience. This self-service option empowers patients and streamlines the office workflow.

Pay-by-Phone or Smartwatch: Utilizing digital wallet technologies allows patients to make secure, contactless payments using smartphones or wearable devices. Aligning with these modern preferences improves the payment experience and meets patients where they are.

Flexible Payment Plans: Offering installment options helps patients manage their healthcare expenses without feeling overwhelmed. Breaking down balances into manageable payments increases the likelihood of collection and boosts patient satisfaction.

Discounts for Prompt Payment: Small incentives for early payment can motivate patients to settle balances sooner. These gestures build goodwill while improving your practice’s cash flow.

When your practice embraces flexibility, you’re accommodating different lifestyles and preferences, along with sending a message that paying bills doesn’t have to be a hassle.

A smooth payment experience reduces frustration, increases on-time payments, and improves patient satisfaction. Additionally, it lightens the load on your staff, who might otherwise spend hours chasing payments or explaining complicated billing processes.

4. Prioritize Upfront Collection

Collecting patient balances at the point of service isn’t always easy, but it’s one of the most effective ways to reduce outstanding balances. When patients pay co-pays, deductibles, or estimated fees upfront, it minimizes confusion later and improves your practice’s cash flow.

Encouraging upfront medical billing collections sends a clear message: payment is a standard part of care, not an afterthought. It also helps patients budget their healthcare expenses more effectively by setting expectations early.

When paying upfront becomes routine, your staff and patients benefit from fewer unpaid accounts and less back-and-forth in the long run. It makes collecting patient balances easy to track.

5. Educate Your Staff

Your front-line team is often the first and sometimes only point of contact patients have regarding their bills. That makes their role critical in the collections process.

When staff are trained to communicate clearly and compassionately about insurance coverage, copays, deductibles, and outstanding balances, it can dramatically improve both the patient experience and payment outcomes.

Explain Insurance Coverage Clearly

- Help patients understand what their insurance covers versus what they owe.

- Avoid jargon and provide real-world examples when possible.

Break Down Copays and Deductibles

- Use simple terms to explain how copays and deductibles are calculated.

- Be transparent about when and why they are due

Discuss Outstanding Balances Tactfully

- Approach the topic with empathy, not pressure.

- Use calm, respectful language to maintain patient trust.

Handle Questions and Objections

- Prepare staff to answer common billing questions with confidence.

- Offer de-escalation strategies for tense conversations.

Encourage Open Dialogue

- Create a safe environment where patients feel comfortable asking about costs.

- Reinforce that there’s no shame in needing clarity or support.

Providing your team with scripts, FAQs, and role-playing opportunities equips them to manage these conversations smoothly and professionally. When staff feel confident and supported, patients respond positively, which leads to more timely payments and stronger relationships.

6. Ensure Timely Refunds

Refunds may not be the first thing that comes to mind when thinking about patient debt collection, but they play a crucial role in maintaining patient trust and satisfaction. When overpayments occur due to insurance adjustments, duplicate charges, or early estimates, patients expect their money to be returned promptly. Failing to do so can leave a lasting negative impression, even if the care itself was excellent.

Fast, transparent refund practices demonstrate integrity and help reinforce that your office treats patient finances with the same care and attention as their health.

Here’s a simple overview of what a timely, professional refund process might look like:

Timely refunds are essential in gaining credibility. When patients see that your practice handles both billing and refunds professionally, they’re more likely to trust your process, pay future balances without hesitation, and speak positively about their overall experience.

7. Strengthen Revenue Cycle

Behind every successful healthcare practice is a well-structured revenue cycle. From the moment a patient schedules an appointment to the final payment resolution, every step matters, and small gaps can lead to major revenue loss.

That’s why investing in a solid revenue cycle management (RCM) strategy is essential.

A strong RCM system ensures:

- Accurate patient intake and insurance verification

- Clear financial communication and upfront estimates

- Streamlined billing and claims processing

- Fast identification of denied claims or missing payments

- Clean, consistent follow-up, both in-house and via professional partners like PRS

By streamlining the entire payment journey, practices collect faster, reduce errors, and spend less time reworking transactions

8. Work with Healthcare Collection Specialists

Sometimes, even with the best internal processes, collecting overdue balances requires outside support. That’s where a professional collection agency experienced in healthcare makes all the difference.

These agencies understand the delicate nature of patient relationships. They’re trained to approach collections with empathy, professionalism, and strict compliance, preserving trust while recovering what’s owed.

Look for an agency that offers:

- Transparent, flat-fee pricing

- Diplomatic, patient-friendly communication

- Integration with your internal workflow

- Online access and reporting tools

- Experience with both consumer and commercial accounts

Choosing the right partner, such as Professional Receivable Solutions LLC, can alleviate your staff’s workload, enhance recovery rates, and maintain your company’s reputation.

Why Partner with Professional Receivable Solutions LLC?

Choosing the right collection partner is crucial for recovering outstanding balances, protecting your brand, time, and customer relationships. At Professional Receivable Solutions (PRS), we help you collect more, spend less, and stay in control, all while maintaining a professional, compliant, and respectful approach.

Here’s how you benefit when you work with PRS:

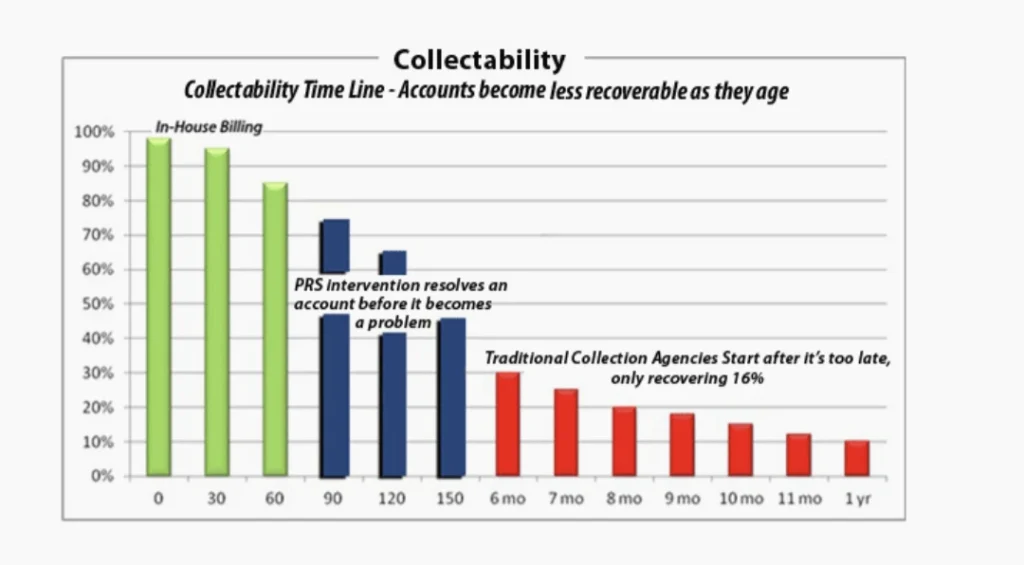

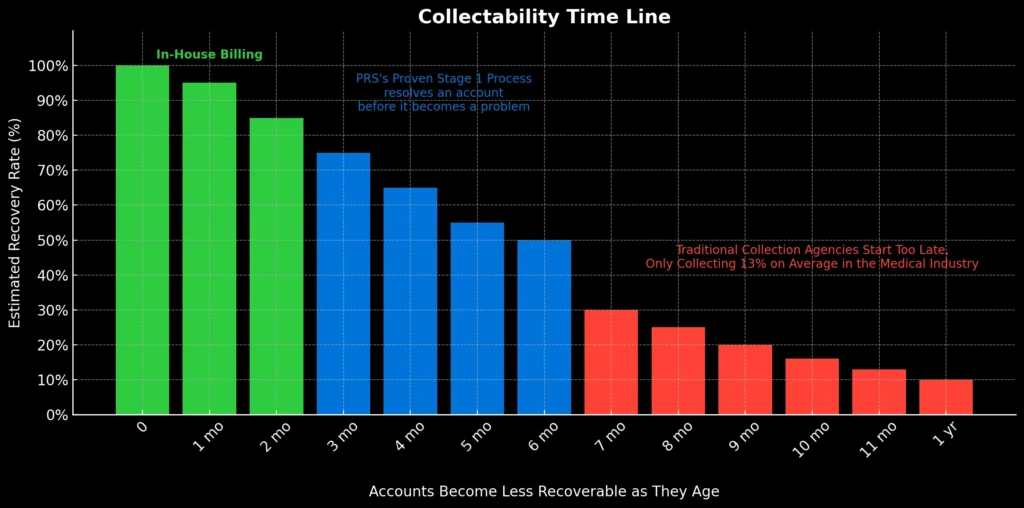

Higher Recovery Rates

Our proven, multi-stage process consistently outperforms traditional collection methods. PRS focuses on early intervention, which results in faster resolutions and unmatched recovery rates across both consumer and commercial accounts. The sooner we start, the more you recover.

Opportunity Cost

Your internal resources are valuable. Instead of having your staff spend hours mailing statements or making unanswered calls, PRS handles the collections process efficiently and effectively. This allows your team to focus on core business functions, while we bring your revenue back in.

Collection Control

With PRS, you retain full control over the collection process. Our client portal enables you to submit, stop, or suspend accounts in real-time, based on direct communication with your clients or patients. You determine the approach, whether it’s a diplomatic touch or a more direct follow-up.

Better Results

Every day, an account ages, and recovery becomes less likely. That’s why PRS’s Stage One process is built to act quickly and diplomatically, helping you generate revenue early in the delinquency cycle, when recovery potential is highest.

Lower Cost Pricing

We eliminate the uncertainty of commission-based collection fees. With PRS, you pay a flat rate averaging $10 per account, regardless of whether the balance is $50 or $50,000. Our pricing is based on system volume, not percentage, making it cost-effective and predictable.

Consumer & Commercial Debt Collection

PRS specializes in both consumer and commercial debt collection, with deep expertise in the healthcare sector. Our patient-focused, compliant approach ensures that your medical practice maintains its professional reputation while recovering what’s owed. In Stage One, 100% of recovered funds are returned directly to your business, no commissions, no compromise.

Boost Collections Without Compromising Care. Choose Professional Receivable Solutions LLC.

At Professional Receivable Solutions LLC, we believe collections shouldn’t come at the cost of your reputation or your patient relationships. Our healthcare-specific approach aims to recover more, reduce internal strain, and maintain trust with every interaction.

Whether you’re dealing with rising patient balances, aged accounts, or limited internal resources, PRS can help you streamline your process and boost results.

Get your free A/R analysis today and discover a better way to recover what’s owed, without compromising patient care or your time.