10 Proven Strategies to Collect Unpaid Business Invoices Faster

If you’re running a business, you know how frustrating unpaid invoices can be. It’s not just about the money but the hours your team spends chasing down payments, the stress of balancing cash flow, and the awkward conversations with clients who are behind. In fact, 42% of companies reported spending more time pursuing accounts that were past due. That’s valuable time you could be investing in growing your business instead.

With the right approach, you can receive your money more quickly, alleviate the strain on your staff, and still maintain strong relationships with your clients.

In this blog, we’ll walk you through the 10 best practices for collecting unpaid business invoices.

10 Best Practices for Recovering Outstanding Invoices Smoothly

Here are 10 tips you can start using today to improve cash flow and make collections less stressful.

1. Assess Your Customers’ Payment Reliability

Before extending credit or signing a contract, take a close look at your customer’s financial stability. Understanding their ability to pay on time can save you headaches later. Review credit reports, payment histories, and industry standing to spot potential risks early.

This step is about making informed decisions that protect your cash flow. By evaluating payment reliability upfront, you can:

- Avoid accounts that are likely to go past due

- Set appropriate payment terms based on risk

- Allocate your resources more effectively

Proactively assessing customers reduces the likelihood of overdue invoices and strengthens your overall collections strategy.

2. Establish Clear Payment Terms

Clear payment terms are the foundation of healthy cash flow. When expectations are spelled out up front, clients know exactly what’s required, and you avoid confusion, disputes, and costly delays later on.

| What to Do | What Not to Do |

| Spell out due dates, accepted payment methods, and late penalties in writing | Assume clients already understand your payment expectations |

| Include terms in contracts, invoices, and purchase orders | Leave terms off paperwork or rely only on verbal agreements |

| Get written acknowledgement (signature, email, or online acceptance) | Skip the documentation that proves the client agreed to the terms |

| Offer early payment discounts to encourage quicker payments | Rely only on penalties without offering positive incentives |

| Communicate terms professionally and consistently | Use vague or overly flexible language that creates room for dispute |

3. Communicate the Importance of Timely Payments

Reminding clients about deadlines doesn’t have to feel pushy. You need to reinforce the value of timely payments for both parties. When clients understand how overdue invoices affect your operations and their services, they’re more likely to pay on time.

Tips for keeping clients aware:

- Regular Reminders: Send polite email or text reminders a few days before the due date.

- Clear Invoicing: Highlight the payment due date prominently on every invoice.

- Explain Impact: Briefly outline how late payments can affect project timelines or service continuity.

- Acknowledge Early Payments: Recognize clients who consistently pay on time to encourage positive behavior.

Maintaining consistent and professional communication sets clear expectations and reduces the likelihood of overdue accounts. Clients will appreciate the transparency and clarity, making timely payments a standard practice rather than an afterthought.

4. Educate Teams on the Sales and Payment Process

Ensuring everyone involved understands the flow of sales and payments can dramatically improve collection efficiency.

- Sales Teams: Equip representatives with insights on negotiating favorable payment terms, understanding the various payment options available to clients, and the financial implications of those terms. Awareness of applicable regulations also ensures compliance throughout the sale process.

- Delivery and Operations: Train these teams to quickly identify and address potential disputes, preventing minor issues from delaying payment

- Management: Utilize clear and accessible dashboards to monitor receivables, communicate status to stakeholders, and inform decision-making.

Remember, prompt payment often follows satisfied customers. By enhancing client experience and resolving issues proactively, your business can maintain loyalty and recover revenue more quickly.

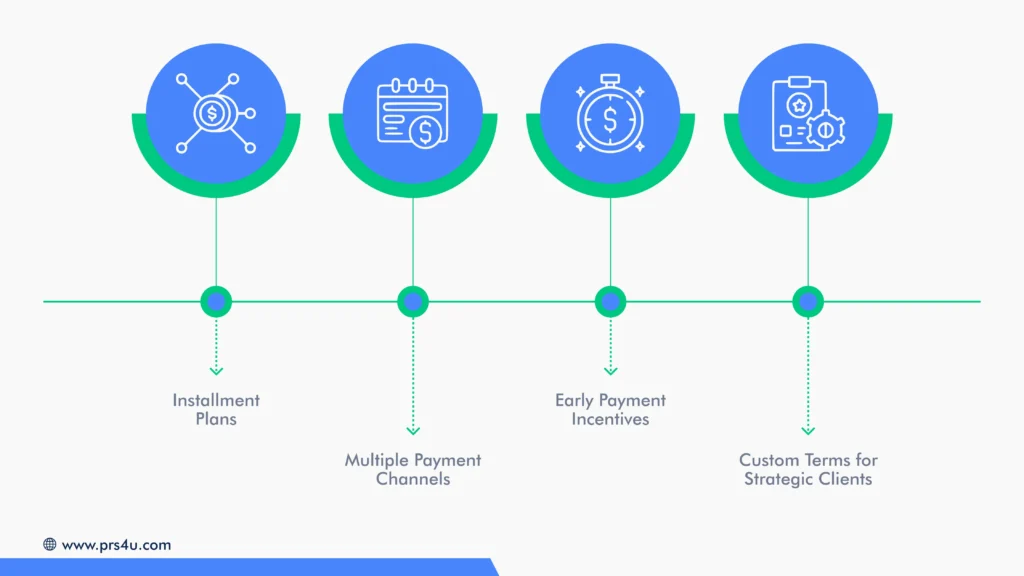

5. Offer Flexible Payment Options

Rigid payment structures can slow down collections and strain client relationships. By providing flexible options, you make it easier for customers to pay on time while reducing the risk of late or missed payments.

Consider these approaches:

- Installment Plans: Break larger invoices into manageable payments to ease client cash flow.

- Multiple Payment Channels: Accept credit cards, ACH transfers, checks, or digital wallets to suit client preferences.

- Early Payment Incentives: Offer discounts or benefits for clients who settle invoices ahead of schedule.

- Custom Terms for Strategic Clients: Adjust payment timelines for key accounts without compromising your overall cash flow.

Flexibility demonstrates understanding and professionalism, encouraging prompt payments while preserving strong business relationships.

6. Tailor Your Collection Strategies to Each Client

Not all clients respond the same way to collection efforts. A one-size-fits-all approach can lead to delayed payments or strained relationships. Defining a clear, client-specific strategy ensures your collection process is both effective and professional.

Start by segmenting clients based on risk and payment history, then adapt your communication style accordingly. Some may respond well to friendly reminders, while others require formal notices or phone outreach.

Establish clear escalation procedures for overdue accounts and maintain detailed records of all interactions. This personalized approach helps improve recovery rates while maintaining positive business relationships.

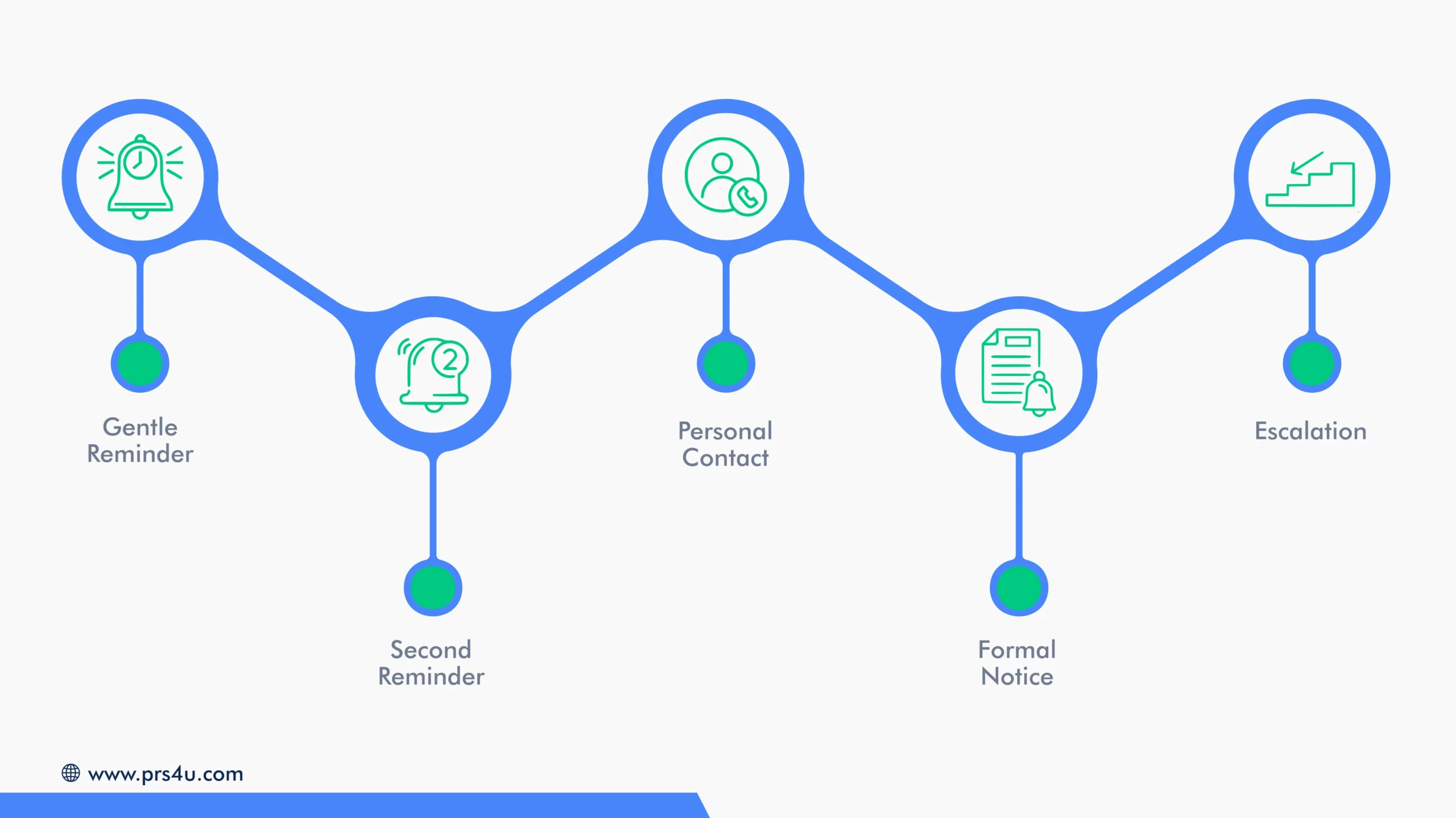

7. Follow Up with Consistent Reminders

A good reminder system works like a sequence. Here’s a simple structure you can adapt to your business:

Step 1: Gentle Reminder

Send a polite nudge a few days before or on the due date. Keep it short and professional, reinforcing the agreed terms.

Step 2: Second Reminder

If payment hasn’t arrived within 7 days, follow up again. Add a bit more urgency, include the invoice copy, and offer an easy way to pay.

Step 3: Personal Contact

Pick up the phone or send a direct email after 14 days overdue. Keep it courteous but clear that the account is outstanding.

Step 4: Formal Notice

At 30 days overdue, issue a formal written notice. Mention any late fees (if applicable) and outline the next steps should the payment remain unpaid.

Step 5: Escalation

If there’s still no resolution, escalate internally or hand the account to a collections partner while documenting all prior contact.

8. Encourage Early Payments with Incentives

Offering early payment discounts can motivate clients to settle invoices sooner, improving your cash flow and reducing the administrative burden of collections. Even a small percentage off the total invoice can create a compelling reason for clients to pay promptly.

Clearly communicate these incentives at the time of contract signing and include them on your invoices as a reminder. Early payment discounts signal to your clients that you value timely payments and are willing to reward responsible financial behavior.

Over time, this approach accelerates collections while fostering stronger client relationships, as businesses appreciate transparent and mutually beneficial terms.

9. Establish a Clear Escalation Process

A well-defined escalation process is crucial for managing overdue invoices efficiently while maintaining healthy business relationships. It ensures that each account is handled consistently and prevents important follow-ups from being overlooked. By establishing clear internal guidelines and client-facing procedures, you can reduce delays, maintain professionalism, and increase the likelihood of successful collections.

Major steps to implement an effective escalation process:

- Initial Reminder: Send a polite, timely reminder immediately after the payment due date.

- Second Notice: Follow up with a more formal message or call if the invoice remains unpaid after a set period.

- Final Internal Review: Assess the account to determine if additional follow-up or escalation is required

- Client Escalation: Clearly communicate potential consequences if payment is not received, such as service suspension or referral to collections.

- External Intervention: Engage a professional collection agency or legal team for persistent accounts while maintaining documentation and compliance.

A structured escalation process ensures your team can act confidently and consistently, improving cash flow without damaging client trust.

10. Consider Professional B2B Collection Services

Sometimes, even the best internal processes cannot recover all outstanding invoices efficiently. Partnering with a professional B2B collection service can save your team time, reduce stress, and maximize your revenue recovery.

Professional Receivable Solutions (PRS) specializes in navigating complex business accounts, handling persistent late payments, and maintaining professionalism to protect your client relationships.

Benefits of engaging a professional collection partner:

- Higher Recovery Rates: Expert strategies and proven processes often recover more revenue than internal efforts alone.

- Time Savings: Your staff can focus on core operations instead of chasing overdue invoices.

- Professional Handling: Sensitive accounts are managed with tact, preserving long-term business relationships.

- Legal Expertise: Agencies are familiar with regulations and escalation procedures, ensuring compliant collections.

- Transparent Reporting: Receive clear updates and documentation on all recovery efforts, keeping you informed at every step.

Why Choose Professional Receivable Solutions LLC?

At PRS, we deliver higher recoveries at lower costs, while giving you full control over the process.

- Higher Recovery Rates: Our early-stage, multi-step process recovers more, faster, across consumer and commercial accounts.

- Save Time and Resources: We handle collections so your team can focus on core operations instead of chasing overdue accounts.

- Stay in Control: Through our client portal, you decide how each account is managed, pause, stop, or escalate in real time.

- Cost-Effective Pricing: No commissions or percentages for Stage 1. An average of $10 per account keeps costs predictable. We have a flexible pricing model for later stages.

- Specialized Expertise: From healthcare to commercial debt, our respectful, compliant approach safeguards your brand while returning 100% of Stage One recoveries directly to you.

Recover Revenue Without the Stress with Professional Receivable Solutions LLC.

Each unpaid invoice impacts your cash flow, delays growth, and burdens your accounts receivable team. PRS brings over 20 years of experience helping businesses recover millions in lost revenue with a structured, efficient, and client-sensitive approach.

Our three-stage collection process ensures your accounts are handled professionally while preserving essential business relationships:

- Stage One – Written Demand: Cost-effective and compliant letters to recover outstanding payments early.

- Stage Two – Personal Outreach: Skilled communication by our team to negotiate payments and resolve disputes promptly.

- Stage Three – Strategic Escalation: Legal or formal actions on viable accounts to secure maximum recoveries.

Whether you’re facing overdue invoices, aging receivables, or stretched internal resources, Professional Receivable Solutions helps you streamline collections and accelerate cash flow.

Get your free A/R analysis today and discover a better way to recover what’s owed, without compromising business relationships.