Myths About Dental Collection Agencies And What Practices Should Really Know

Running a dental practice can be rewarding, but managing overdue accounts can be a task. When payments get piled up and your team is already overburdened, the idea of hiring a collection agency might cross your mind.

But several questions may occur. Will they harass my patients? Will I lose valuable relationships? Is it even worth the cost?

If you have ever hesitated to work with a dental collection agency because of concerns like these, now is the time to clear your myths. There is a lot of misinformation floating around that makes practice owners second-guess what could actually be a wise business decision.

Let us clear the air and separate fact from fiction to know about dental collection agencies’ myths so you can make the best choice for your practice and your patients.

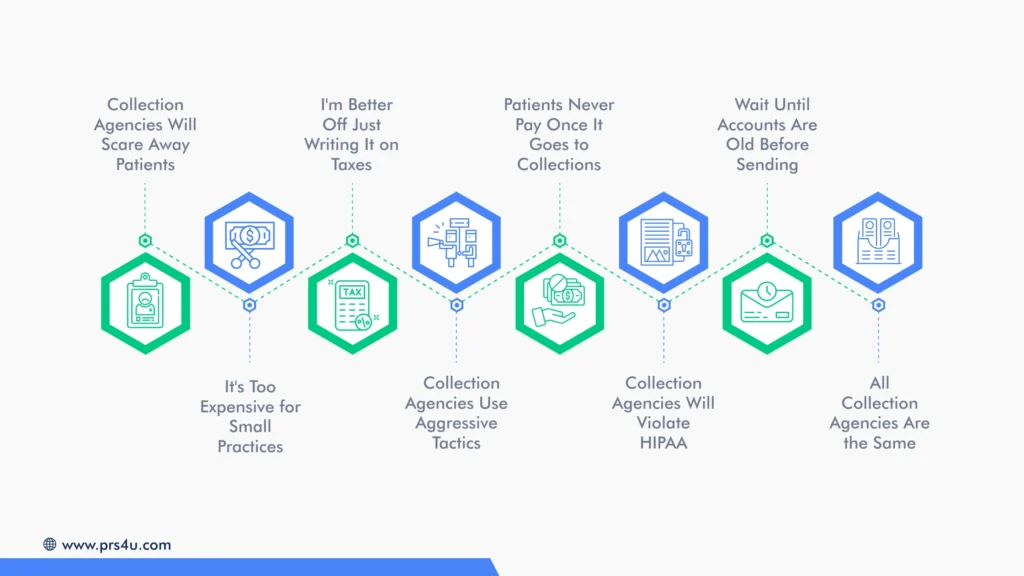

Top 8 Myths About Dental Collection Agencies

Many of the worries surrounding collection agencies come from outdated assumptions or misinformation. Let’s take a closer look at the myths that cause the most confusion.

1. Myth #1: Collection Agencies Will Scare Away Patients

This is probably the biggest fear practice owners have, and honestly, it makes perfect sense. You have worked hard to build trust with your patients. The last thing you want is someone calling them up and destroying that relationship over an unpaid bill.

Here’s the reality: reputable dental collection agencies don’t operate like that. They understand that your patients are people going through tough times. Professional collectors approach these conversations with empathy and respect.

Professional Receivable Solutions LLC follows a standard practice for collecting patient balances. Here’s how PRS4U handles patient relationships differently:

| Common Fear | How PRS Actually Operates |

| Aggressive phone calls | Diplomatic, 3-stage process starting with gentle reminders |

| Damaged patient relationships | Trained collectors who prioritize empathy and respect |

| Patients are never coming back | Focus on preserving the practice-patient relationship |

| Embarrassing confrontations | HIPAA-compliant, confidential communication methods |

Think about how your team handles a missed payment. You don’t yell at patients or threaten them, right? You calmly explain the situation and try to work something out. That’s precisely what PRS4U does; they’re just more experienced at having these difficult conversations.

2. Myth #2: It’s Too Expensive for Small Practices

When you are already overseeing every dollar, adding another expense can seem absurd, especially when you are struggling with cash flow issues from unpaid accounts. Many practice owners assume collection agencies charge hefty upfront fees or take such a large percentage that it’s barely worth the effort.

The reality is quite different. Most dental collection agencies work on a contingency basis, which means they only get paid when they successfully collect money for you. If they don’t recover anything, you don’t owe them anything. It’s that simple.

PRS4U provides a flat-fee Structure:

- Average cost: $10 per account

- No percentage fees during Stage One

- You recover 100% of the revenue collected in the first stage

- No upfront costs, contingency-based model available

When you consider that your dental hygienist or office manager spends hours each month chasing down payments, the cost of professional collection services often pays for itself quickly.

3. Myth #3: I’m Better Off Just Writing It on Taxes

Yes, you can write off bad debt on your taxes. But here’s the thing: a tax deduction is not the same as actual cash in your bank account. When you write off a $500 unpaid bill, you are not getting $500 back; you are just reducing your taxable income by that amount.

Meanwhile, if a collection agency recovers even 50% of that debt, you’ve got $250 in real money that can be used to buy supplies, pay staff, upgrade equipment, or simply improve your cash flow. Some agencies even offer programs where you keep 100% of what’s collected during the early stages of the collection process.

Think about your practice’s needs right now. Would you rather have a small tax benefit months from now or actual revenue coming in that can help you meet payroll next week? For most practices, cash flow wins every time.

With PRS4U’s Stage One Program:

- You keep 100% of the revenue collected

- Zero percentage fees during initial collection efforts

- Real money hits your account fast

- Better cash flow means you can invest in practice growth

4. Myth #4: Collection Agencies Use Aggressive Tactics

This myth likely comes from those old movie stereotypes: the intimidating collector who shows up at someone’s door or makes threatening phone calls. While those practices may have existed decades ago (and, unfortunately, still occur with disreputable companies), they’re illegal now.

Professional collection agencies operate under strict regulations, particularly the Fair Debt Collection Practices Act (FDCPA). They can’t harass people, use abusive language, call at inappropriate times, or threaten actions they can’t legally take. Dental collection agencies, especially those specializing in healthcare, go even further because they understand the importance of maintaining patient dignity.

Here’s what ethical collectors actually do: they reach out with respectful communication, explain the situation clearly, listen to the patient’s circumstances, and work together to create a reasonable payment plan. They’re trained in conflict resolution and customer service.

5. Myth #5: Patients Never Pay Once It Goes to Collections

Some practice owners believe that once an account reaches the collection stage, it’s almost unrecoverable. If patients haven’t paid you directly, why would they pay a collection agency?

There are several reasons why collection agencies often succeed where practices struggle. First, they have dedicated staff whose entire job is focused on recovery; they’re not juggling appointments, insurance claims, and patient questions at the same time. They can be persistent without being pushy because it’s their specialty.

Second, patients sometimes take collection notices more seriously than practice reminders. When an account moves to collections, it signals a more formal step in the process, which can motivate action. The potential impact on credit scores also becomes a real consideration.

Third, professional collectors have access to skip-tracing methods and resources that help them locate patients who’ve moved or changed contact information. Your front desk probably doesn’t have time to track down someone who’s dodging calls, but collection agencies do.

6. Myth #6: Collection Agencies Will Violate HIPAA

This is a legitimate concern, and it’s smart to think carefully about patient privacy. After all, collection agencies need access to patient information to do their job, and any breach of protected health information could result in massive fines and damage to your reputation.

It’s important to work with agencies that specialize in healthcare collections and understand HIPAA compliance inside and out. These agencies implement strict security measures, including encrypted data transmission, restricted access controls, comprehensive staff training, and secure storage systems.

Before working with any collection agency, they should sign a Business Associate Agreement (BAA) with your practice. This is a legally required HIPAA document that outlines their responsibilities for protecting patient information. They should only access the minimum necessary information needed to collect the debt.

Reputable agencies also follow the “minimum necessary” standard, meaning they share as little information as possible in their communications.

7. Myth #7: Wait Until Accounts Are Old Before Sending

Some practices wait six months, a year, or even longer before sending accounts to collections, thinking they should exhaust every possible in-house option first. Why give up a percentage of the payment if there’s still a chance you can collect it yourself?

Here’s the problem: the older an account gets, the harder it becomes to collect. Patients move, change phone numbers, become less financially stable, or simply become more entrenched in not paying. Studies consistently show that collection rates drop dramatically as accounts age.

Many successful practices actually partner with collection agencies much earlier in the process, sometimes as early as 60-90 days past due. Some agencies offer multi-stage collection programs where early intervention attempts use softer, reminder-based communication before escalating to more formal collection efforts.

The right spot is often around 90-120 days past due. At this point, you’ve given patients a reasonable time to pay, but the debt is still fresh enough that recovery is likely.

8. Myth #8: All Collection Agencies Are the Same

This is like saying all dental practices are the same. Collection agencies vary widely in their specialization, approach, technology, success rates, and pricing models.

Some agencies handle all types of debt, like credit cards, auto loans, medical bills, retail accounts, and treat everything the same way. Others specialize specifically in healthcare or even more specifically in dental practices. The specialized agencies understand your unique challenges: insurance coordination issues, treatment plan confusion, financial hardship situations, and the importance of maintaining patient relationships.

When researching agencies, look for those with:

- Specific dental or healthcare experience: They will understand your industry’s unique challenges and regulations

- Transparent pricing: Clear fee structures with no hidden costs

- Flexible programs: Options for different account types and aging periods

- Technology integration: Online portals where you can submit accounts, track progress, and generate reports

- Positive references: Other dental practices willing to vouch for their professionalism and results

- Clear compliance measures: Documented HIPAA protocols and willingness to sign a BAA

What Should Dental Practices Expect from a Professional Collection Agency?

Now that we have spoken about these myths, let us talk about what you should really expect from a professional dental collection agency. Here are some elements that will work for you:

- They’re an extension of your team. The best agencies see themselves as partners who represent your practice professionally. They should take time to understand your practice culture and communicate in ways that align with your values.

- They offer control and flexibility. You should be able to submit accounts easily, pause collection efforts if a patient contacts you directly, and stop the process entirely if needed. You’re still in charge.

- They provide transparency. Modern agencies offer online portals where you can see exactly what’s happening with each account when contacts were made, what was discussed, and what payments have been collected.

- They protect relationships when possible. While they can’t guarantee every patient will be happy about collection calls, professional agencies work to preserve relationships by treating people with respect and dignity throughout the process.

- They improve your practice operations. By taking collection work off your team’s plate, agencies free up staff time for patient care, treatment coordination, and other revenue-generating activities.

Don’t let myths and misconceptions keep your practice from the financial health it deserves. Every day you wait is another day of lost revenue sitting in aging accounts receivable.

Break the Myths and Boost Recovery With PRS | Professional Receivable Solutions

Many practices still hesitate to work with a collection agency because of outdated assumptions. The truth is simple: modern, HIPAA-compliant dental collections protect patient relationships and strengthen your financial stability. Professional Receivable Solutions LLC offers a respectful, structured approach that clears up the myths and shows practices what today’s collection support actually looks like.

Your team stays focused on care, your cash flow improves earlier in the revenue cycle, and you maintain full visibility and control at every step.

Here’s what practices consistently experience with PRS4U:

- Stronger Recovery Performance: A clear, diplomatic three-stage process that achieves higher returns without aggressive tactics.

- Reduced Administrative Burden: Staff no longer spend hours chasing balances, giving them more time for real patient interactions.

- Flexible Account Management: Submit, pause, or stop accounts instantly based on your conversations with patients.

- Improved Outcomes on Slow-Pay Accounts: Early engagement keeps balances from aging into the point where recovery becomes unlikely.

- Straightforward Pricing: Flat-fee averaging $10 per account, no matter the balance.

- Consumer and Commercial Collections: Recover 100% of Stage One payments with no percentage-based fees.

If your practice is ready to move past the myths, protect patient loyalty, and recover revenue with confidence, PRS4U is here to help.

Get your free A/R analysis today and see how a compliant, patient-friendly approach restores unpaid balances while safeguarding your reputation.