How to Hire a Debt Collection Agency and Maximize Recovery Results?

Unpaid invoices can quietly drain the life out of a business. They don’t just disrupt cash flow. They delay payroll, strain vendor relationships, and distract your team from what drives business growth.

This isn’t a rare problem. A study on invoice payment behavior found that nearly half of SME and B2B invoices in the U.S. and U.K. are paid beyond their due dates. That’s time and cash flow no one plans for, and it adds up quickly.

If you’ve ever paused your day to send one more reminder or field a vague excuse, you know exactly how draining and unproductive the process can be. That’s where a professional collection agency comes in to protect your time, your sanity, and your customer relationships.

In this blog, we’ll discuss

- 6 real, measurable benefits of hiring a collection agency,

- How to hire a collection agency and the major factors that matter most when choosing the right partner, and

- How to approach the decision with clarity, confidence, and control.

Getting paid shouldn’t feel like a battle, and it definitely shouldn’t distract you from growing your business.

6 Benefits of Hiring a Collection Agency

Outsourcing collections is about applying the right expertise at the right time. Many businesses hesitate to take this step, assuming it’s only for extreme cases or that it might damage their customer relationships. However, in reality, working with a professional collection agency can bring structure, strategy, and scale to a problem that has been handled re-actively for too long.

Below are eight practical, results-driven reasons to consider when you’re wondering how to hire a debt collection agency.

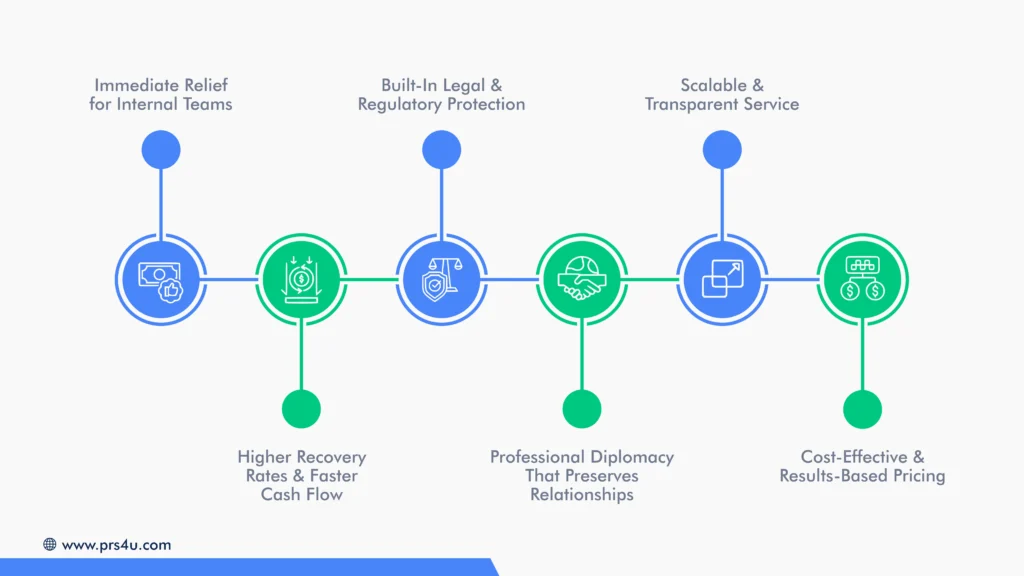

1. Immediate Relief for Internal Teams

Each follow-up call, email, or skip-trace pulls valuable time away from service, innovation, and growth.

| Food for Thought: Where’s Your Team’s Time Really Going?

Every minute your team spends chasing overdue accounts is a minute not spent growing your bottom line. If one staff member spends just 15 minutes on five overdue accounts each day, that adds up to 306 hours a year, costing your business between $4,896 and $7,344 annually, depending on their hourly rate.

Now, imagine channeling that time into service, innovation, or growth. |

By choosing to hire a collection agency, you can immediately free up your staff’s time and reduce the stress of chasing overdue payments.

2. Higher Recovery Rates & Faster Cash Flow

Collection agencies operate differently. They’re structured for focus and follow-through. With dedicated systems, trained staff, and established workflows, they move quickly and persistently, often initiating action within days of placement.

This speed matters. Faster outreach leads to:

- Higher recovery rates on fresher accounts

- Less strain on your working capital

- Better predictability in your cash flow

PRS’s team acts fast, provides better results, with initial contact often made within 48 hours of account placement. By prioritizing early-stage resolution, we help clients avoid the compounding risk of aging invoices and re-engage debtors while accounts are still recoverable.

Moreover, our structured 3-stage recovery process is backed by over two decades of results. Our tailored outreach is based on account type and industry, making the conversation more productive and the resolution more likely.

| What Success Can Look Like

One clinic saw a 27% drop in unpaid balances after implementing upfront payment discussions. |

3. Built-In Legal & Regulatory Protection

A complex web of federal and state laws governs debt collection. From the Fair Debt Collection Practices Act (FDCPA) to data protection regulations and healthcare-specific rules, such as HIPAA, compliance mistakes can quickly become costly.

A reputable collection agency thoroughly understands these regulations. Their teams are trained to:

- Avoid prohibited practices (e.g., after-hours calls, harsh language)

- Log every contact for audit-ready documentation

- Secure all consumer data

4. Professional Diplomacy That Preserves Relationships

Aggressive in-house demands can alienate long-standing customers or patients. Skilled agents strike a balance between assertive and respectful, using empathetic scripts to keep dialogues solution-focused.

The right agency knows how to strike a balance between assertive and respectful. They’re trained to:

- Use non-threatening, professional language

- Approach conversations with empathy and tact

- Keep the focus on resolution, not blame

- Represent your business with the same professionalism you would expect from your own staff

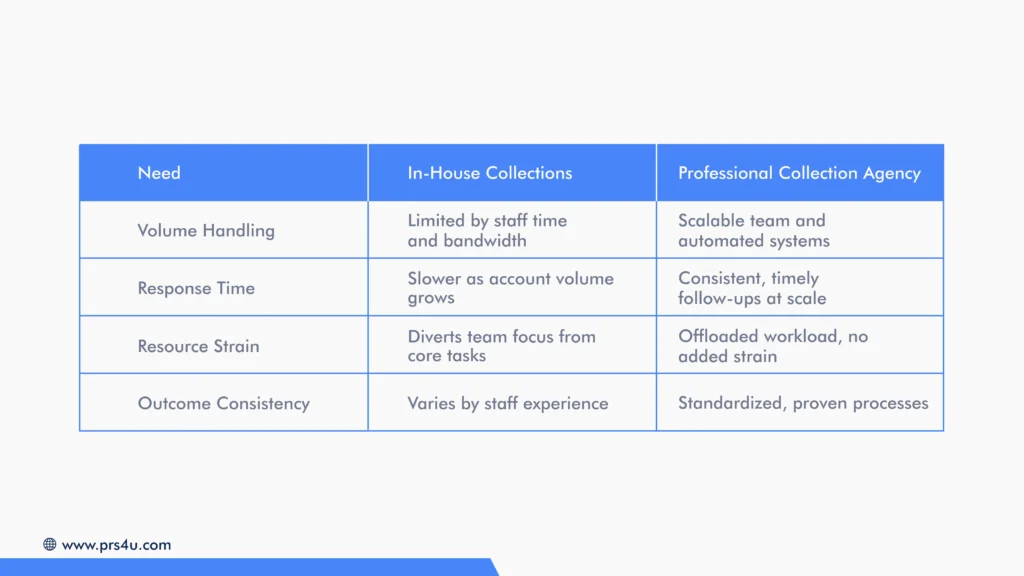

5. Scalable & Transparent Service

Whether you place ten accounts or ten thousand, a collection agency’s infrastructure scales with volume spikes without requiring extra hiring or a backlog.

Here’s how internal efforts compare to agency support as your volume increases:

PRS offers 24/7 client portal access, allowing you to monitor each account, pause activity, and generate reports at any time. This level of transparency provides you with complete control and peace of mind, eliminating the need for follow-up calls or emails.

With modern collection agencies like PRS, you can expect:

- Real-time access to account status and payment activity via an online portal

- Customizable reports based on your preferred frequency (weekly, monthly, quarterly)

- Performance metrics that show recovery rates, contact history, and account status

- Audit-ready documentation in case of disputes, compliance reviews, or internal oversight

- Dedicated support to walk you through insights and trends

6. Cost-Effective & Results-Based Pricing

Most agencies offer two budget-friendly models:

- Flat-Fee Pricing: You pay a fixed rate (often as low as $10 per account with agencies like PRS), regardless of the balance size. This is ideal for early-stage recovery when balances are still fresh and relationships are worth preserving.

- Contingency-Based Pricing: You only pay if the agency successfully collects the amount. This model aligns incentives and ensures you’re not paying for effort—you’re paying for results.

Both beat the quiet costs of internal pursuit: staff hours, delayed cash, and compliance exposure.

How to Hire a Debt Collection Agency: Important Factors to Consider?

Hiring a collection agency isn’t just a financial decision; it’s a relationship decision. This partner will be an extension of your business, representing your brand and interacting with your customers. That means who you choose matters just as much as when you decide to get help.

Here are the factors that truly matter when selecting a collection agency that’s aligned with your goals, values, and financial strategy:

1. Industry Experience That Matches Your Needs

Not all agencies are created equal, and neither are your accounts. A collection partner with industry-specific experience, whether in healthcare, B2B services, retail, or commercial finance, can offer real advantages:

- Understands the tone, regulations, and expectations specific to your industry

- Speaks the language of your customers or patients

- Anticipates common objections and communication challenges

- Navigates sensitive issues like insurance, copays, or HIPAA privacy (in healthcare)

- Increases recovery rates while reducing friction throughout the process

Asking the right questions about licensing, compliance, and relevant experience helps ensure your partner is aligned with your needs from day one.

2. Legal Compliance and Licensing

Confirm that the agency is licensed, bonded, and fully compliant with relevant collection laws, such as the FDCPA and HIPAA (for healthcare), as well as any applicable state-level regulations. Legal missteps can turn a collections problem into a liability problem.

A reputable collection agency should be able to provide documentation of its licenses and demonstrate a track record of ethical, compliant practices. In today’s environment, where consumers are well-informed about their rights, a non-compliant call or letter can escalate quickly. Working with a compliant agency protects your business reputation and shields you from lawsuits, fines, and costly disputes down the road.

3. Approach to Communication and Tone

Your collection partner should reflect your company’s values, not contradict them. Evaluate how they communicate with your customers or patients.

- Are they tactful?

- Do they use plain language?

- Can they adjust the tone based on account type?

The tone used in collection conversations can either preserve or permanently damage your customer relationships. A skilled agency knows how to be firm without being rude and persistent without being aggressive. Ask if their staff undergoes empathy training, and find out how they de-escalate difficult calls. Their approach should align with your brand’s reputation for professionalism, service, and respect.

4. Transparent Pricing and Fee Structure

Understand how you’ll be charged. Are there flat fees? Contingency rates? Minimums or hidden charges? Transparency upfront in collection agency rates protects you from surprises later and makes it easier to forecast collection ROI.

It’s worth inquiring about how fees are calculated, particularly for accounts of varying sizes or ages. Some agencies charge more for older debts, while others have tiered pricing based on volume. If an agency is vague about its pricing or seems hesitant to give clear answers, that’s a red flag.

You deserve to know what you’re paying for and when. Hiring collection agency services isn’t just about fees; it’s about finding a partner that fits your business culture and legal needs.

5. Technology and Reporting Capabilities

Modern agencies should offer more than spreadsheets. Inquire about software features such as client dashboards, automated updates, and real-time reporting to maintain control and keep stakeholders informed.

A strong reporting system should include:

- Number of contact attempts and successful engagements

- Communication methods used (calls, texts, emails)

- Time taken to resolve each account

- Number of accounts still in progress

- Customizable reports based on your internal KPIs

A tech-savvy agency gives you visibility, saves time, and delivers insights, not just data.

6. Reputation, References, and Recovery Rates

Look beyond their website. Check testimonials, case studies, or even request references. You want to know not only that they can collect but that they do so reliably, professionally, and respectfully.

Recovery rate claims should be backed by real data, not just marketing language. Don’t hesitate to ask for performance benchmarks or average recovery percentages by account age or industry. If possible, speak with clients who have worked with them for a long time. A strong reputation isn’t built overnight; consistent results and respectful handling of accounts earn it.

7. Control and Flexibility for Your Team

Some agencies offer pause or suspend controls, allowing you to stop the activity if a customer resumes contact or resolves the balance directly with you. Choose a partner who enables your team to stay informed and in control.

Collection doesn’t have to be “all or nothing.” The right agency will let you customize the level of involvement you want, whether that means sending early-stage accounts only or involving you in the escalation process. They should also offer flexible submission formats and support integration with your existing billing or CRM software to reduce admin burden.

Questions to Ask Before You Hire a Collection Agency

Hiring a collection agency is all about trust, transparency, and alignment with your business values. Before you commit, take the time to ask the right questions. A reputable agency won’t hesitate to answer and will appreciate that you’re doing your due diligence.

Here are the most important questions to ask during your evaluation process:

- Are you licensed to collect in the state(s) where my debtors reside?

- What industries do you specialize in?

- How do you handle consumer complaints or disputes?

- What’s your recovery rate compared to the industry average?

- Can I see a sample report or dashboard?

- What’s your escalation process for unresponsive accounts?

These questions will help you go beyond the sales pitch and find a collection agency that works with you, not just for you. After all, this is a relationship that impacts your revenue, your time, and your reputation.

Turn Unpaid Invoices Into Predictable Revenue With Professional Receivable Solutions LLC

At Professional Receivable Solutions (PRS), we believe debt recovery shouldn’t strain your resources or your reputation. Our business-friendly, flat-fee collection model helps you recover more while protecting customer goodwill and internal bandwidth.

Whether you’re struggling with overdue invoices, rising accounts receivable (A/R), or simply need a more brilliant collection strategy, PRS offers proven results without pressure.

Want to see what better collections can look like for your business? Get your free A/R analysis today – no pressure, just real insights.