How to Improve Cash Flow for Small Businesses Through Professional Collections

Late payments continue to place a significant strain on small businesses across various industries. According to a survey, three in four small companies experience a delay in payment of invoices.

When revenue is tied up in accounts receivable, small businesses struggle to pay suppliers, meet payroll, or reinvest in their operations. This doesn’t just create short-term stress; it undermines long-term viability. That’s where professional collections can help restore balance; not through aggressive tactics, but through strategic systems that turn aging invoices into predictable income.

In this blog, we’ll discuss how to improve cash flow in a small business by partnering with the right collection agency. We’ll break down what a professional agency can offer, the impact on internal teams and timelines, and why outsourcing collections can create a healthier financial foundation for future growth.

How Do Collections Boost Cash Flow & Financial Health of a Business?

Maintaining healthy cash flow is vital for small businesses to stay afloat and grow. Efficient collections play a major role in accelerating payments and minimizing financial risks. By implementing strategic collection practices, businesses can improve liquidity and reduce losses caused by bad debt.

Here’s how professional collections contribute to a stronger cash flow management for small businesses:

Accelerate Payment and Stabilize Liquidity

- Speed up cash inflows to support daily operations like payroll and supplier payments

- Reduce reliance on costly external financing or credit lines

- Enhance financial flexibility for cash flow management of unexpected expenses or investment opportunities

- Create a consistent cash flow that strengthens business resilience

Minimize Bad Debt Risk

- Early outreach improves the chances of recovering overdue payments and helps increase business cash flow

- Lower write-offs by addressing delinquent accounts promptly

- Protect profit margins and improve net income

- Maintain better credit ratings and financial reputation

How Can a Business Improve Cash Flow Through Debt Collection

Healthy cash flow depends on more than making sales. It depends on actually collecting what’s owed. Many small business owners wait weeks or even months to receive payments that should have arrived long ago. Without a consistent process in place, this delay becomes the norm.

The most effective businesses treat collections as part of their everyday financial operations, not an afterthought. They don’t wait until an invoice is overdue to follow up. Instead, they build clear expectations in every step of their client communication.

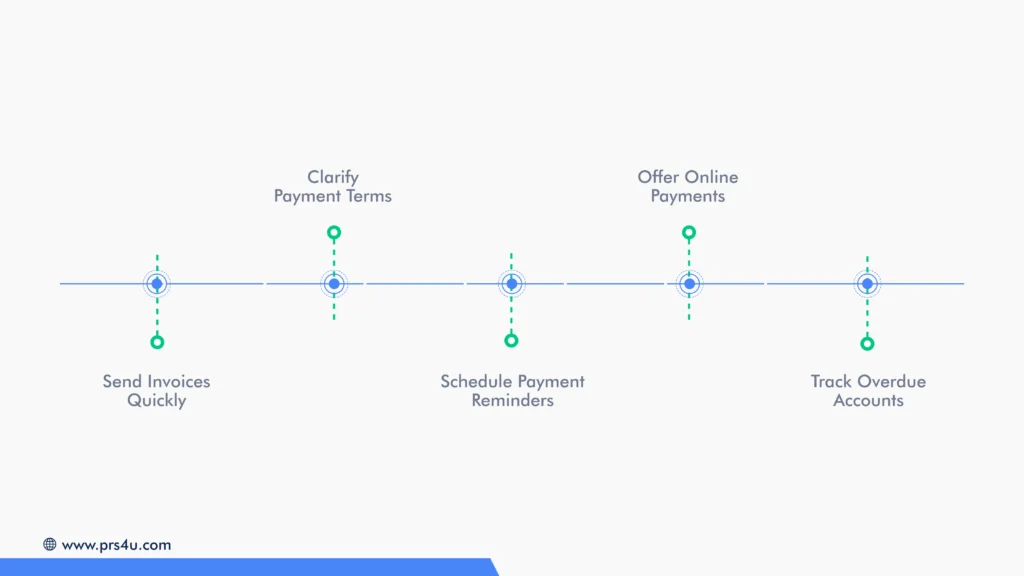

Here are a few habits that help you learn how to improve cash flow from operations and maintain a steady income:

1. Send Invoices Quickly

Speed matters when it comes to invoicing. The sooner your invoice reaches a client, the sooner they can process it, and the less likely it is to get lost in a backlog or delayed by internal approvals. Timely invoicing signals professionalism and helps set the tone for how you expect payments to be handled.

Many small businesses unintentionally create cash flow gaps by delaying invoices until the end of the week or month, often resulting in financial difficulties. However, waiting even a few days can push your payment timeline out by weeks, especially if the client’s payment cycle only occurs on specific dates. Instead, aim to send invoices within 24 hours of completing a job or delivering a product. If you’re using accounting software, set up automated invoicing triggers tied to project completion or delivery confirmations. Over time, this small adjustment can create a more reliable and predictable cash flow rhythm.

2. Clarify Payment Terms

Confusion causes delays, and nowhere is this more true than with payment terms. Vague or inconsistent language on an invoice can slow down approval, create unnecessary back-and-forth, or lead to unintentional non-payment. Clear terms will protect your business legally and set the expectations right from the start.

Use plain language to outline when payment is due, what forms of payment are accepted, and what happens if payment is delayed. Repetition helps too. Include this information in your contracts, invoices, and onboarding materials to ensure visibility.

Here are a few ways to increase cash flow by simplifying and reinforcing your payment terms:

- State due dates clearly, using terms like “Net 15” or “Due upon receipt.”

- List all accepted payment methods (bank transfer, card, digital wallet, etc.)

- Explain any penalties for late payments or benefits for early ones

- Provide contact details for billing-related questions

- Use consistent language and formatting across all documents

When clients know what to expect, they’re more likely to pay promptly, with no chasing required.

3. Schedule Payment Reminders

Consistency in following up on overdue invoices can help in improving cash flow and profits. Establishing a clear, step-by-step reminder schedule helps maintain professionalism and keeps the communication respectful while encouraging prompt payment.

A sequence might begin with a polite email reminder shortly after an invoice becomes overdue. If there’s no response, a friendly phone call can add a personal touch and clarify any issues causing the delay. When necessary, escalate the communication to a more formal letter or a final notice before considering external collection options.

Sticking to a defined schedule benefits your business by:

- Showing customers that you take payments seriously

- Reducing the risk of payments falling through the cracks

- Creating documented evidence of your efforts in case of disputes

Having a structured approach ensures you’re neither too passive nor overly aggressive. This balance preserves customer relationships while reinforcing the importance of timely payment.

4. Offer Online Payments

Providing customers with convenient online payment options can expedite the payment process and minimize delays. Digital payment solutions, such as credit card payments, ACH transfers, or payment portals, make it easier for clients to settle invoices promptly, eliminating common barriers like mailing checks or visiting physical locations.

Offering multiple secure online options increases the likelihood that customers will pay on time, improving your cash flow predictability. Many platforms also send automatic payment confirmations and reminders, which help both parties stay informed and reduce the chances of miscommunication.

Benefits of online payments include:

- Faster transaction processing

- Reduced administrative workload for your team

- Enhanced payment tracking and reporting capabilities

Integrating online payment options into your billing process demonstrates professionalism and aligns with customer expectations in today’s digital world, helping your business get paid quickly and smoothly.

5. Track Overdue Accounts

Consistent monitoring of overdue invoices is vital for maintaining healthy cash flow. Reviewing your accounts receivable on a weekly basis ensures that no unpaid invoices slip through the cracks and allows you to act promptly on late payments.

Documenting every follow-up, whether by email, phone, or message, creates a clear record of your collection efforts. This documentation can prove invaluable if disputes arise or if you decide to escalate the matter to a professional collection agency later.

A systematic tracking process helps your team stay organized, demonstrates professionalism to clients, and supports better decision-making about when to intensify collection actions.

Major practices include:

- Setting a weekly review schedule for overdue accounts

- Logging details of each contact attempt and customer response

- Using software tools or spreadsheets for consistent record-keeping

By maintaining clear records and staying proactive, businesses can enhance recovery rates and mitigate the overall impact of late payments on their cash flow.

While these habits can strengthen internal processes, many small business owners simply don’t have the time or resources to manage collections consistently. That’s why outsourcing to a professional agency is often the smarter, more sustainable choice.

Benefits of Professional Debt Collection

Outsourcing collections isn’t just about getting paid, it’s about doing it smarter. Here’s why partnering with a professional agency can make a difference:

- Expertise and Efficiency

Outsourcing to a professional agency ensures that trained specialists handle your collections, people whose sole focus is recovering outstanding payments quickly and diplomatically. This enables your internal team to focus on core business tasks. - Legal Compliance and Risk Reduction

Professional collectors possess in-depth knowledge of debt collection laws and regulatory requirements. Their experience helps mitigate the risk of legal missteps that could result in costly penalties or reputational harm. - Tactful Customer Handling

Specialized agencies know how to manage sensitive conversations with tact and professionalism, preserving customer relationships while still recovering funds. - Advanced Collection Methods

Agencies employ various methods to enhance cash flow, including skip tracing, automated workflows, and customized scripts, to increase contact rates and improve recovery outcomes. Their structured, multi-stage approach targets past-due accounts promptly, facilitating quicker resolution. - Better Cash Flow

With faster recovery processes and higher success rates, professional collectors contribute directly to healthier cash flow and financial stability. - Operational Focus for Your Team

By handing over collections to experts, your team is freed from the stress and time drain of chasing payments, empowering them to focus on business growth instead. - From Reactive to Proactive

Outsourcing turns collections into a strategic asset. Instead of reacting to overdue invoices, you proactively manage receivables, supporting your company’s financial health and long-term goals.

How to Choose the Right Collections Partner

Now that you know how to improve cash flow in a small business through collections, you need to choose a collections partner. Selecting the right collections partner can make a significant difference in efficiently recovering overdue payments while maintaining your business’s reputation. Not all agencies offer the same level of service or expertise; therefore, it’s essential to carefully evaluate potential partners.

1. Industry Expertise and Compliance

Look for a collections agency experienced in your industry. This ensures they understand the specific regulations, customer expectations, and nuances of your business sector.

PRS, for example, specializes in both consumer and commercial debt collection, with deep expertise in healthcare. Our team navigates complex regulations, including HIPAA, while maintaining compliance with federal laws such as the FDCPA.

2. Transparent and Flexible Pricing

An ideal partner provides clear pricing options suited to your business size and needs. PRS offers flat-fee pricing averaging at $10 per account (based on volume), eliminating commission surprises and enabling more accurate budgeting. These flexible pricing models make professional collections accessible and predictable for small businesses.

3. Communication and Customer Care

Effective collections balance assertiveness with respect. Choose a partner trained to communicate diplomatically, protecting your customer relationships. PRS emphasizes empathy and professionalism in every interaction, helping reduce friction while encouraging timely payments.

4. Technology and Reporting

Visibility into collection progress helps you stay informed and in control. PRS provides 24/7 access to an online client portal with real-time updates, detailed reports, and customizable dashboards. This transparency supports better cash flow forecasting and strategic decision-making.

5. Reputation and Proven Results

Consider agencies with a strong track record and positive client testimonials. PRS boasts higher recovery rates than many of its competitors and a 97% client retention rate, reflecting its commitment to delivering results without compromising integrity.

Choosing PRS means partnering with a team that values your time, reputation, and revenue equally, helping your business improve cash flow through professional, ethical, and practical collections.

Unpaid Invoices? Let Professional Receivable Solutions LLC Help You .

Stop letting unpaid invoices hold your business back. Learn how to improve cash flow in a small business with Professional Receivable Solutions (PRS). We deliver expert, compliant, and affordable collections that protect your reputation while efficiently recovering your revenue.

Start today with a free accounts receivable analysis and discover how PRS can help you simplify collections, reduce bad debt, and strengthen your financial health.

Request free A/R analysis today to regain control of your overdue accounts and turn outstanding payments into reliable cash flow.