Top Challenges in Medical Debt Collection and How Providers Can Address Them Responsibly

Rising healthcare costs have become one of the most pressing financial concerns for families across the United States. For providers, this means an increasing number of patients struggle to pay their bills on time, leaving balances unresolved and revenue tied up. Just under 50% of U.S. adults say affording health care costs is difficult, and one in four report that they or a family member had problems paying for care.

This financial pressure creates a ripple effect. Providers must balance the need to maintain financial stability with the responsibility of supporting patients who are already burdened by medical expenses. It’s a challenge that requires more than standard collection tactics. It calls for strategies that prioritize both recovery and empathy.

In this blog, we’ll look at the top challenges in medical debt collection and how providers can address them responsibly.

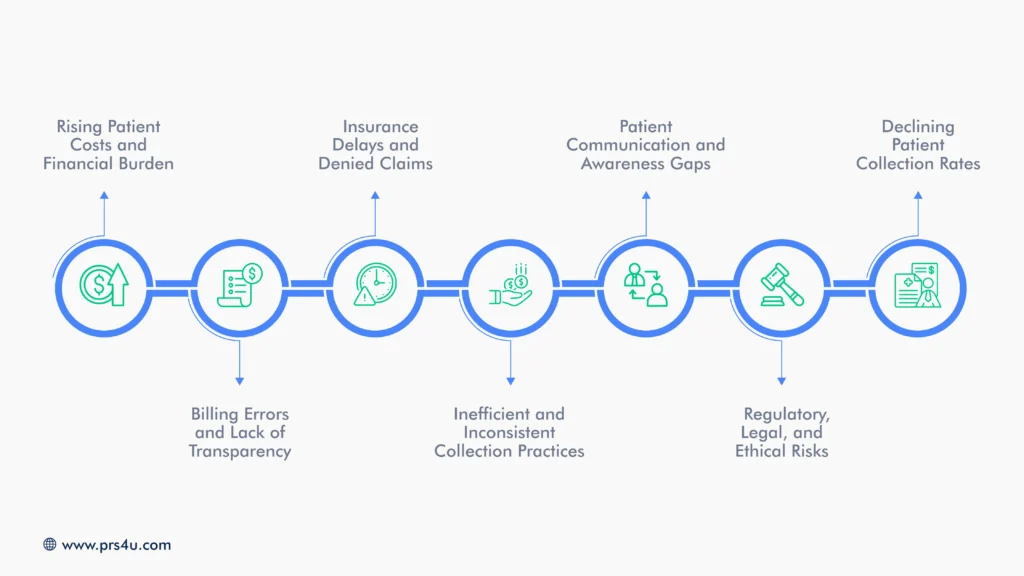

Common Challenges in Medical Debt Collection

Medical debt recovery isn’t just about sending reminders or following up on unpaid balances. Providers face a complex mix of obstacles that go beyond the standard business environment, from navigating strict regulations to maintaining patient trust while protecting their bottom line. Understanding these challenges is the first step toward building approaches that are both effective and compassionate.

1. Rising Patient Costs and Financial Burden

One of the most pressing issues in medical collections today is the growing share of health expenses patients must cover directly. Even with insurance, many individuals face steep deductibles, rising copays, and treatment costs that can quickly overwhelm household budgets. This shift places a heavier financial burden on patients and makes repayment less predictable for providers.

Common out-of-pocket expenses include:

- High deductibles that must be met before insurance coverage begins

- Specialist copays and procedure fees not fully covered

- Prescription drug costs that accumulate over time

- Unexpected emergency bills that disrupt family finances

These expenses often create a cycle where patients delay or avoid payments, leaving providers with aged receivables and reduced cash flow. For healthcare organizations, this means navigating a delicate balance: maintaining financial stability while addressing the real financial struggles patients face. Without a thoughtful approach, the gap between what patients owe and what providers collect continues to widen.

2. Billing Errors and Lack of Transparency

Complicated billing remains one of the most common reasons patients fall behind on payments. Healthcare statements are often filled with medical jargon, duplicate charges, or line items that are difficult to interpret. When patients don’t fully understand what they owe, or suspect errors in their bill, they are far less likely to pay promptly.

Frequent issues include:

- Inaccurate charges that do not match the care received

- Duplicate bills sent for the same service or procedure

- Unexpected balances due to unclear insurance coverage

- Lack of upfront pricing or cost estimates before treatment

These problems create frustration and erode trust between patients and providers. A lack of clarity can leave individuals feeling misled or overwhelmed, prompting them to delay payment while seeking clarification. For providers, the ripple effect is longer collection cycles, reduced patient satisfaction, and a greater need for follow-up communications.

3. Insurance Delays and Denied Claims

Insurance-related challenges add another layer of complexity to medical debt collection. When claims are denied, underpaid, or delayed, patients are often left with unexpected balances they may not be prepared to cover. At the same time, providers must absorb administrative costs while navigating appeals and resubmissions.

Common obstacles include:

- Slow reimbursement cycles that extend payment timelines

- Claim denials due to coding errors, missing information, or policy exclusions

- Insurance verification gaps at the time of service

- Shifting coverage rules that leave patients confused about their responsibility

Patients may feel unfairly burdened by costs they assumed would be covered, while providers face stalled revenue and increased labor in chasing claims. Ultimately, both sides lose valuable time and resources, making proactive insurance management essential.

4. Inefficient and Inconsistent Collection Practices

When a healthcare organization lacks standardized procedures for collections, the process often becomes fragmented and ineffective. Manual follow-ups can lead to missed opportunities, while inconsistent communication across staff may create confusion for both patients and internal teams.

Outdated technology further compounds the problem, leaving providers without the tools to track accounts or automate reminders.

Typical challenges include:

- Manual and time-consuming follow-ups that slow down recovery

- Variation in staff approaches leading to inconsistent patient experiences

- Limited visibility into account status without centralized systems

- Outdated or missing automation tools that reduce efficiency

These inefficiencies delay payments and risk damaging patient trust when communication feels disorganized or repetitive. A lack of streamlined workflows ultimately places added pressure on staff while diminishing the provider’s ability to maintain healthy cash flow.

5. Patient Communication and Awareness Gaps

One of the most common hurdles in medical debt collection is the lack of clear, timely communication with patients. Many patients are unaware of what portion of their care is covered by insurance, what they personally owe, or that a bill has even been issued. When notices arrive late or are written in overly technical language, they only add to the confusion.

Major issues that arise include:

- Unclear billing statements that make it difficult to identify charges

- Late or infrequent notifications leaving patients surprised by outstanding balances

- Limited upfront communication about expected out-of-pocket costs

- Overly complex insurance explanations that are hard for patients to interpret

These gaps leave patients feeling blindsided, which delays payments and also hamper trust between providers and their communities. Clear, patient-friendly communication is essential to close this gap and foster a cooperative approach to resolving balances.

6. Regulatory, Legal, and Ethical Risk

Medical debt collection sits at the centre of healthcare regulation, consumer protection laws, and ethical patient care standards. Even minor missteps can lead to serious consequences, from lawsuits to reputational damage. Providers and collection agencies must navigate a complex environment where financial recovery and compliance go hand in hand.

Some of the most pressing risks include:

- Errors in credit reporting that misstate balances or timelines, damaging patients credit unfairly.

- Incorrect debt assignments where debts are pursued even after being resolved, written off, or misallocated.

- Privacy breaches if sensitive patient health or financial data is mishandled or shared improperly.

- Reputational harm when aggressive or noncompliant practices become public, eroding community trust in the provider.

These risks highlight why medical debt collection cannot follow the same playbook as other industries. Every action must be carefully aligned with legal requirements such as HIPAA and the Fair Debt Collection Practices Act (FDCPA), while also upholding the ethical duty of care.

7. Declining Patient Collection Rates

One of the most pressing challenges in medical debt collection today is the steady decline in patient payment rates. As healthcare costs rise and insurance plans shift more financial responsibility onto individuals through higher deductibles and co-pays, more patients struggle to cover their balances in full.

This trend reduces revenue recovery and places providers in a difficult position: pushing too hard risks damaging patient relationships, while doing too little leaves practices vulnerable to financial instability.

Several factors contribute to this decline. Patients may be dealing with competing financial priorities such as housing, utilities, or credit card debt, which often take precedence over medical bills. Economic uncertainty and inflation amplify these pressures, leaving patients with limited capacity to pay even modest balances. Additionally, many patients lack a clear understanding of their bills due to complex insurance processes, which can delay or discourage repayment altogether.

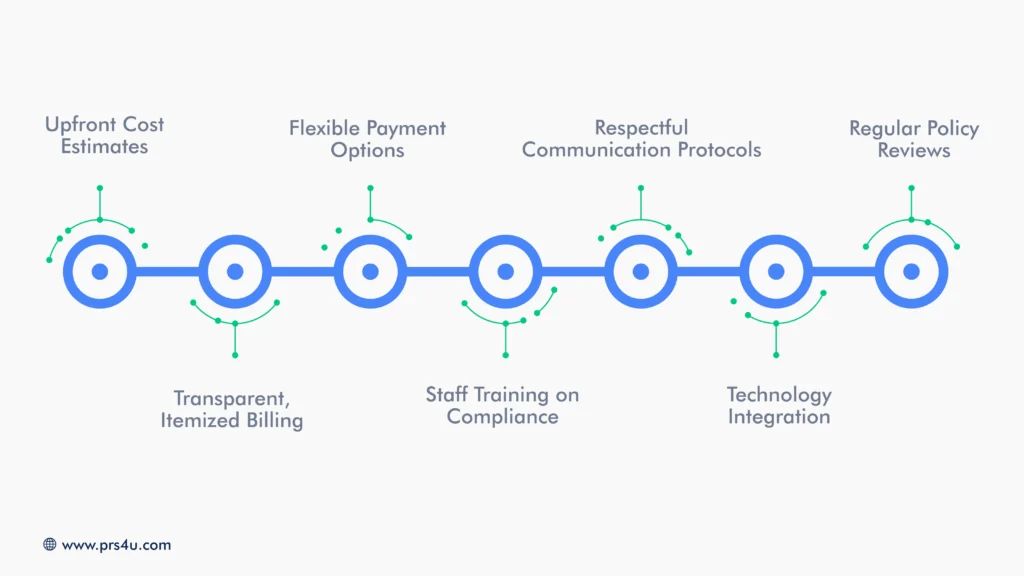

How Providers Can Address These Challenges Responsibly

While the challenges in medical debt collection are real and growing, they can be addressed in ways that protect both patient dignity and provider stability. Responsible strategies focus on combining transparency, flexibility, and compliance with patient-centered communication.

Upfront Cost Estimates

Providing patients with clear cost estimates before treatment reduces surprise bills and builds trust. When patients understand their potential out-of-pocket responsibility early, they are more prepared and less likely to delay payment.

Transparent, Itemized Billing

An easy-to-read bill that clearly outlines services, insurance adjustments, and patient responsibility minimizes disputes and confusion. Transparency supports cooperation and faster resolution of balances.

Flexible Payment Options

Offering installment plans, hardship programs, or deferred payments helps patients manage obligations realistically. This approach prevents delinquency and preserves relationships.

Staff Training on Compliance

Ongoing training ensures staff understand privacy laws, billing regulations, and ethical collection practices. It reduces errors and protects providers from legal or reputational harm.

Respectful Communication Protocols

A respectful, empathetic tone in collection outreach helps protect patient trust. Clear communication avoids escalation while keeping the payment process professional.

Technology Integration

Automating billing, claims processing, and reminders improves efficiency, reduces manual errors, and frees staff to focus on patient care.

Regular Policy Reviews

Healthcare regulations and patient needs change. Reviewing and updating collection policies ensures providers remain compliant and responsive.

By approaching collections with empathy, clarity, and accountability, healthcare providers can improve recovery rates without compromising care or reputation.

Protect Patient Trust While Recovering Revenue With Professional Recovery Solutions

Balancing patient care with financial recovery doesn’t have to feel like a trade-off. With the right strategies, providers can protect their revenue while maintaining compassion, compliance, and trust.

At Professional Receivable Solutions, we specialize in medical debt collection that puts patient dignity first while delivering measurable results. Our approach combines:

- Professional, respectful communication that preserves patient relationships

- Compliance-driven processes to safeguard privacy and reduce legal risk

- Tailored recovery strategies aligned with your organization’s goals

- Transparent reporting so you always know where each account stands

- Operational relief by handling collections so your staff can focus on care

Don’t let unresolved balances compromise your financial health. Partner with Professional Receivable Solutions(PRS) to recover outstanding payments responsibly and protect the trust your patients place in you.