Accounts Receivable (AR) Aging Report: What Is It & Why Is It Important?

Late payments are more common than most businesses would like to admit. Research shows that nearly 39% of invoices in the U.S. are paid late, and most of those customers push payments beyond agreed-upon terms. These delays put pressure on cash flow, slow down growth plans, and increase the risk of bad debt.

An Accounts Receivable (AR) Aging Report is one of the most effective methods to bring clarity to this challenge. Breaking down outstanding invoices into time brackets helps businesses see exactly where money is tied up and which accounts need urgent attention. Without this insight, overdue balances can easily slip through the cracks, resulting in losses that could have been avoided.

In this blog, we will discuss what an aged debtors report is, how it works, and why it plays a crucial role in maintaining a business’s financial health.

What Is an Accounts Receivable (AR) Aging Report?

An Accounts Receivable (AR) Aging Report is a financial statement that shows all unpaid customer invoices, organized by how long they’ve been outstanding. Instead of treating all receivables the same, the report breaks them down into time brackets, commonly 0–30 days, 31–60 days, 61–90 days, and 90+ days overdue.

This format gives businesses a clear picture of:

- Who owes money (customer name and invoice details)

- How much they owe (individual and total balances)

- How long payments have been overdue (aging categories)

By presenting invoices in this manner, the report highlights payment trends. For example, if a client consistently falls into the 61–90 day bracket, that’s a signal to tighten credit terms or prioritize collection efforts.

An aged debtor’s report is a decision-making method. It helps businesses gauge the effectiveness of their credit policies, anticipate potential cash flow gaps, and identify accounts that may be at risk of default. In short, it transforms raw receivables data into actionable insight.

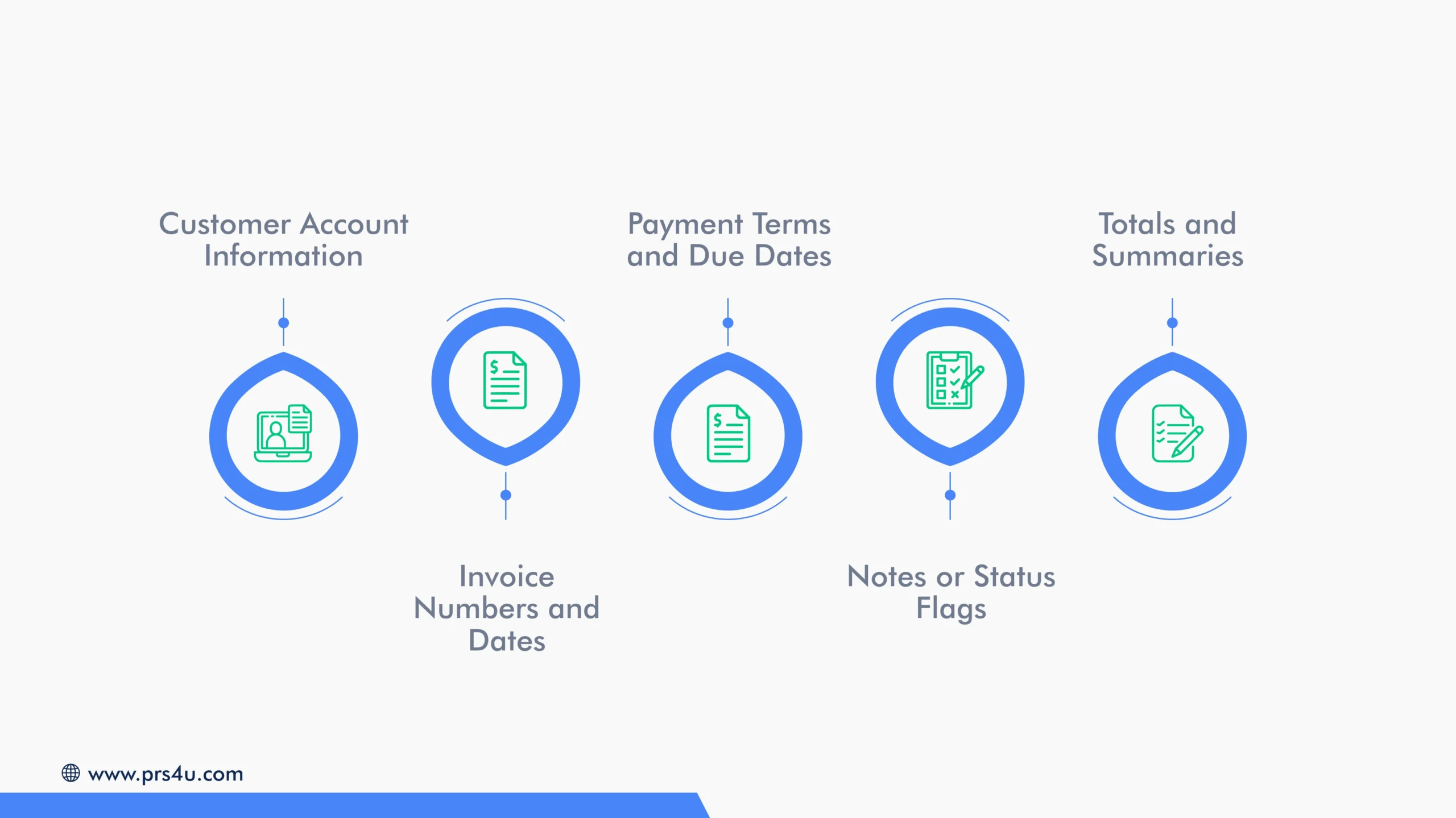

Common Components of the Accounts Receivable (AR) Aging Report

An Accounts Receivable (AR) Aging Report provides structured details that allow businesses to track, analyze, and act on receivables with clarity. While the exact layout can vary depending on the accounting system or reporting method, most reports include the following elements:

An Accounts Receivable (AR) Aging Report provides structured details that allow businesses to track, analyze, and act on receivables with clarity. While the exact layout can vary depending on the accounting system or reporting method, most reports include the following elements:

1. Customer Account Information

Each debtor is listed with clear identifiers, such as company name, account number, and, in some cases, contact details. This ensures collection teams know exactly which client is associated with each overdue balance.

2. Invoice Numbers and Dates

Reports usually include invoice numbers and issue dates. This helps match payments against specific transactions and avoids confusion when clients dispute outstanding amounts.

3. Payment Terms and Due Dates

Beyond simply showing the age of debt, many reports record the agreed credit terms alongside the original due date. This context makes it easier to assess if late payment is a one-off delay or a recurring issue.

4. Notes or Status Flags

Some reports allow the addition of notes, dispute codes, or flags to indicate the current status of an overdue account, for example, “awaiting client confirmation,” “under review,” or “in collections.”

5. Totals and Summaries

In addition to individual line items, a well-structured report provides subtotals by customer and an overall outstanding balance. This allows managers to assess total exposure quickly at a glance.

Together, these components create a report that is not just a list of debts, but a practical tool for tracking obligations, resolving disputes, and managing cash flow more effectively.

Why is an Accounts Receivable (AR) Aging Report Important for Businesses?

Unpaid invoices can have a direct impact on cash flow, decision-making, and even long-term growth for many businesses. By identifying which customers are behind on payments and how long their debts have been outstanding, this report becomes a powerful tool for reducing risk and protecting revenue.

1. Gain True Visibility into Payment Behavior

An Accounts Receivable (AR) Aging Report gives you a transparent view of how customers are actually paying, and not just how they say they will. By categorizing overdue invoices into time brackets, it quickly shows which clients consistently pay on time, which ones regularly stretch your credit terms, and which accounts are drifting into risky territory.

This visibility is crucial because late payments aren’t always isolated events. They often follow patterns. A client who frequently appears in the 31–60 day bucket, for example, may be signaling financial strain or a lack of payment discipline. With this insight, you can:

- Identify reliable customers who can be offered favorable credit terms.

- Spot repeat offenders and tighten credit limits or require upfront deposits.

- Proactively manage risk by addressing issues before debts spiral into defaults.

Ultimately, the report transforms receivables from a static list of overdue invoices into a dynamic map of customer payment behavior, helping you protect cash flow and strengthen financial planning.

2. Prioritize Collections & Reduce Risk

An Accounts Receivable (AR) Aging Report helps you decide where to focus your collection efforts first. By segmenting overdue invoices into clear aging brackets, the report highlights the oldest and riskiest debts, giving your team a clear starting point.

Instead of chasing every unpaid invoice with the same urgency, you can:

- Prioritize high-value overdue accounts that have the biggest impact on your cash flow.

- Escalate older debts in the 90+ day category before they become uncollectible.

- Assign collection strategies based on invoice age, from friendly reminders for new delays to firmer action for chronic late payers.

This targeted approach reduces wasted effort, speeds up recoveries, and limits the chances of writing off bad debt. Over time, it also improves your Days Sales Outstanding (DSO), an essential metric for measuring the efficiency of your receivables process. It shows how many days, on average, it takes a company to collect payment after making a sale.

When used consistently, the report becomes both a financial safeguard and an early warning system, helping you manage exposure before it turns into a costly problem.

3. Support Strategic Financial Decisions

When you know exactly how much cash is tied up in overdue invoices, you can make more accurate forecasts, plan expenses with confidence, and spot potential liquidity challenges before they disrupt operations.

For example, suppose a large portion of receivables regularly shifts into the 60–90 day range. In that case, that trend can signal weaknesses in your credit policies or highlight customers who may need stricter payment terms. On the other hand, consistently clean reports indicate a strong receivables process that supports business growth.

Finance teams can also use the report to align working capital management with strategic planning. By understanding payment behaviors in advance, companies are better prepared to invest in opportunities, manage debt obligations, and maintain financial stability even when cash inflows slow down.

In this way, the Accounts Receivable (AR) Aging Report becomes a forward-looking tool that informs policy adjustments and keeps your business resilient in a competitive environment.

4. Improve Credit Management & Forecasting

An Accounts Receivable (AR) Aging Report also strengthens your ability to manage credit risk and plan for the future. By identifying overdue balances and tracking customer payment patterns, you can anticipate potential losses and refine your approach to credit control. This makes it easier to separate healthy accounts from those at risk and to plan provisions accordingly.

With this insight, businesses can:

- Estimate doubtful debts more accurately, improving financial reporting and compliance.

- Forecast cash flow with greater precision by factoring in delayed payments.

- Adjust credit terms for clients who frequently extend beyond agreed timelines.

- Strengthen liquidity planning by understanding when and how receivables are likely to convert into cash.

Used consistently, the report helps reduce surprises, supports better decision-making, and ensures your business remains financially resilient even when client payments slow down.

5. Create Operational Efficiency

An Accounts Receivable (AR) Aging Report also streamlines internal workflows by making collections more systematic and less reactive. Instead of manually sifting through invoices to see which accounts are overdue, the report automatically organizes receivables into clear categories. This reduces administrative effort, minimizes errors, and ensures nothing slips through the cracks.

Many businesses also integrate aged debtor reporting into their accounting software, allowing real-time updates and automated reminders for overdue accounts. This not only saves staff time but also ensures consistency in how payment issues are handled. With fewer manual tasks, finance teams can focus on higher-value activities, such as refining credit policies and supporting growth initiatives.

Ultimately, the report drives efficiency across the collections process while providing leadership with a clearer view of the overall health of receivables.

How to Act on Each Aging Bracket?

An Accounts Receivable (AR) Aging Report is only valuable if it drives action. Each time bucket signals a different level of urgency, and taking the right steps at the right stage can prevent overdue balances from becoming uncollectible.

Recommended Actions by Aging Category:

| Timeline | Action |

| 0–30 Days | Send polite reminders and confirm the customer has received the invoice. Offer simple payment options to encourage prompt settlement. |

| 31–60 Days | Step up communication with follow-up emails or phone calls. Reconfirm due dates and flag accounts showing recurring delays. |

| 61–90 Days | Escalate your approach. Pause further credit until payment is made and keep a clear record of all communications. |

| 90+ Days | Treat as high-risk. Engage a collections partner or explore legal recovery options, as balances in this bracket are least likely to be paid voluntarily. |

Pros and Cons of an Accounts Receivable (AR) Aging Report

Examining the benefits of managing aged debtors and the risks of overlooking them underscores the significant value this report can bring to business planning.

| Pros | Cons |

| Highlights which customers delay payment and by how long | Doesn’t explain why invoices are late without added analysis |

| Prioritizes collections by risk/age and invoice value | No industry benchmark unless external data is used |

| Improves cash-flow forecasting and informs credit limits/terms | Can drive poor decisions if outdated or reviewed infrequently |

| Supports estimating bad-debt provisions and compliance reporting | Needs supporting policies (credit checks, deposits, reminders) |

Best Practices for Using the Accounts Receivable (AR) Aging Report

An Accounts Receivable (AR) Aging Report delivers the most value when it’s not just created, but actively used as part of your receivables strategy. Here are the best practices that ensure the report drives real results:

- Review Regularly: Don’t let reports gather dust. Reviewing your aged debtors weekly or monthly keeps you ahead of potential issues and ensures that overdue balances are managed before they spiral out of control.

- Follow Up Promptly: The longer an invoice sits unpaid, the harder it becomes to collect. Use the report to prioritize immediate follow-up on the oldest or largest debts and prevent payment delays from becoming write-offs.

- Refine Credit Terms: Patterns revealed in the report provide valuable insights into customer behavior. Consistent late payers may require stricter credit terms, shorter payment windows, or upfront deposits. Adjusting policies based on trends strengthens your credit management over time.

- Combine with Bad Debt Analysis: Not every overdue invoice will be collected. By combining the Accounts Receivable (AR) Aging Report with bad debt analysis, you can estimate doubtful accounts and set realistic provisions in your financial statements. This ensures that your books accurately reflect the actual value of receivables and reduces the risk of unexpected surprises.

Turn Your Accounts Receivable (AR) Aging Report Into Cash Flow With Professional Receivable Solutions, LLC.

An Accounts Receivable (AR) Aging Report protects cash flow, improves credit control, and makes smarter financial decisions.

If your reports are showing mounting overdue invoices, that’s a signal that it’s time to act. Professional Receivable Solutions, as a trusted partner in commercial debt recovery, helps businesses turn aged debtor insights into tangible results.

How PRS Supports Your Business

- Professional Collections: We recover overdue accounts quickly and respectfully.

- Client Relationship Protection: Our approach safeguards your reputation while securing payments.

- Tailored Strategies: Recovery plans planned around your industry, customer base, and goals.

- Transparent Reporting: Real-time updates keep you informed at every step.

- Reduced Burden: Free your team from chasing payments so they can focus on growth.

Don’t let overdue invoices hold back your business. Turn your Accounts Receivable (AR) Aging Report into a roadmap for stronger cash flow with PRS by your side.