What Every Dental Practice Needs to Know About Dental Debt Collection Compliance

A busy dental office runs on precision. Every chart, treatment plan, and patient conversation depends on accuracy. Behind that clinical care, however, sits a quieter process that carries its own set of risks: billing and debt collection. Many practices focus on recovering overdue payments but overlook how easily a single compliance misstep can lead to regulatory trouble.

According to a recent report, the average time to identify and contain a data breach has reached 241 days. That means sensitive patient information could remain exposed for nearly eight months before detection. The impact extends beyond fines or audits. It can hamper patient confidence and damage a practice’s reputation permanently.

Compliance in dental debt collection protects data and relationships, ensuring that financial recovery occurs responsibly. Dental practices that understand these obligations position themselves for long-term stability, avoiding costly penalties and maintaining the trust that keeps patients returning.

Compliance Pitfalls in Dental Debt Collection

Even with strong regulations and clear guidelines, many dental practices still fall short of full compliance in their collection efforts. Small oversights can quickly become major liabilities, especially when patient data and financial communication intersect.

Most violations stem from inconsistent processes, outdated systems, or a lack of staff awareness about compliance boundaries rather than intent.

Common pitfalls include:

- Unclear Data-Sharing Practices: Many offices fail to properly document what patient information is shared with third-party agencies, leaving gaps in audit trails and increasing breach risk.

- Overreliance on Manual Workflows: Paper-based or loosely tracked communication can result in missing consent records or unverified debt information.

- Inadequate Training: Staff members who handle billing or collections often lack ongoing education on changing compliance rules, leading to accidental disclosures or improper phrasing in collection notices.

- Delayed Breach Response: Practices without a defined response plan lose precious time after a security incident, amplifying damage and penalties.

- Mixing Clinical and Financial Data: Integrating clinical details into financial correspondence, even unintentionally, can violate HIPAA’s minimum necessary rule.

Avoiding these pitfalls requires a proactive strategy that combines technology, staff training, and regular compliance audits to close gaps before they become regulatory or reputational setbacks.

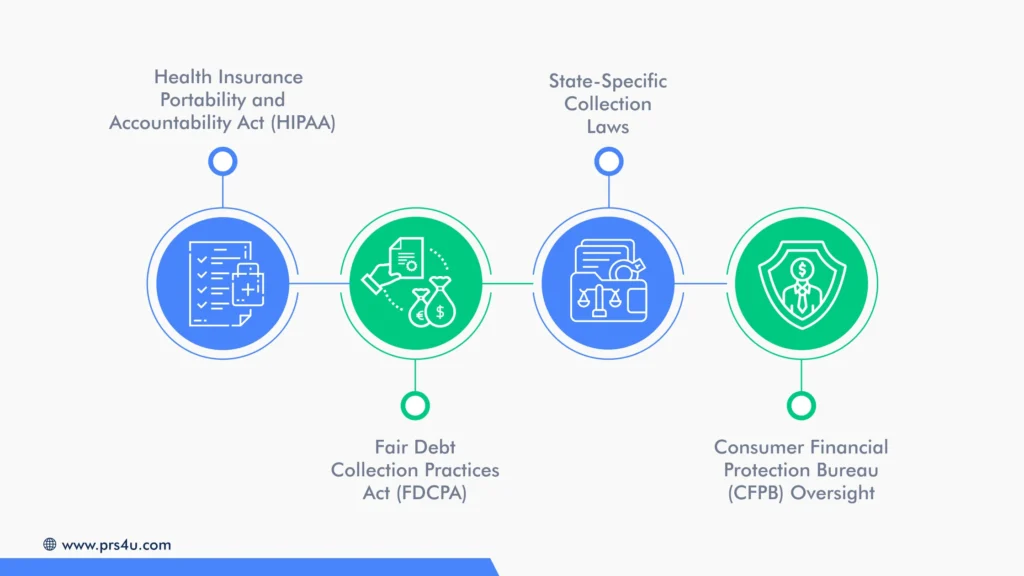

Regulatory Framework for Dental Debt Collections

Dental practices face the same collection regulations as other healthcare providers, yet the nuances can be easily overlooked. The intersection of healthcare privacy laws and consumer protection rules means that every communication, data transfer, and record update must follow strict legal boundaries.

Several core regulations guide compliant dental debt collection:

1. Health Insurance Portability and Accountability Act (HIPAA)

HIPAA sets the national standard for protecting patient privacy throughout the billing and debt collection process. Every dental practice handles protected health information (PHI), like names, treatment records, and billing details, that must be safeguarded against misuse or unauthorized disclosure.

Once a collection agency becomes involved, that responsibility extends beyond the practice walls. HIPAA requires that any disclosure of PHI to a third party comply with strict privacy and security measures.

Crucial areas of HIPAA compliance in dental debt collection include:

- Minimum Necessary Standard: Only disclose the information needed to pursue payment.

- Business Associate Agreements (BAAs): Ensure formal agreements are in place with agencies that handle PHI.

- Data Security Measures: Encrypt data, secure electronic transmissions, and restrict unauthorized access.

- Ongoing Training and Audits: Maintain staff awareness and verify that collection partners follow HIPAA-aligned safeguards.

These measures help prevent data leaks, identity theft, or the accidental exposure of patient information, risks that could lead to severe fines and damage to patient trust. Practices must also confirm that their collection partners follow these same standards consistently. True HIPAA compliance is not a one-time certification but a shared and continuous process of accountability, vigilance, and secure handling of patient data.

2. Fair Debt Collection Practices Act (FDCPA)

The Fair Debt Collection Practices Act (FDCPA) regulates the pursuit and collection of consumer debts, including dental balances. Its purpose is to protect patients from unfair, deceptive, or aggressive tactics while ensuring that businesses recover what they are owed through lawful and ethical means. Every dental practice partnering with a collection agency must ensure that its representatives uphold these standards during every stage of communication.

Major compliance areas under the FDCPA include:

- Respectful Communication: Collectors must contact patients only at appropriate times and avoid harassment or repeated calls.

- Accurate Information: Debt details must be clearly verified, including the amount owed and the original creditor’s identity.

- Prohibition of Misleading Practices: Agencies cannot threaten legal action or penalties they do not intend to pursue.

- Validation Notices: Written notice must be provided to patients within five days of initial contact, outlining their rights to dispute the debt

These regulations promote transparency and fairness throughout the collection process. Any violations, such as disclosing patient debts to unauthorized parties or using aggressive language, can result in legal penalties and reputational harm.

Aligning with FDCPA guidelines protects both the dental practice and the patient relationship, ensuring that recovery efforts remain professional, compliant, and ethically sound.

3. State-Specific Collection Laws

Each U.S. state enforces its own set of regulations governing debt collection, and dental practices must remain aware of these regional differences. State-specific laws often expand upon federal standards, such as the FDCPA, by imposing additional requirements related to licensing, communication limits, and disclosure practices. Ignoring these details can expose a practice to penalties, lawsuits, or even suspension of collection privileges within that state.

Major areas where state laws may differ include:

- Licensing Requirements: Some states require third-party collection agencies to hold valid licenses or register with state authorities before contacting patients.

- Interest and Fee Regulations: State laws may limit the interest rates or administrative fees that can be added to a patient’s overdue balance.

- Notification and Disclosure Rules: Certain states mandate specific wording in collection letters or additional disclosures about consumer rights.

- Time Limits for Debt Collection: Statutes of limitations vary widely, determining how long a debt can be legally pursued.

Dental practices working across multiple states need to ensure their internal teams and collection partners understand and follow these nuances. A compliant strategy involves regularly reviewing state-level updates and maintaining documentation that proves adherence to local and federal laws, minimizing risk while preserving patient trust.

4. Consumer Financial Protection Bureau (CFPB) Oversight

The Consumer Financial Protection Bureau (CFPB) serves as the primary federal authority overseeing fair and ethical debt collection across all industries, including dental practices. This agency enforces compliance with consumer protection laws and investigates violations that could harm patients financially or emotionally. For dental offices and the agencies they partner with, staying aligned with CFPB standards helps ensure transparency, accuracy, and respect in every communication.

Primary CFPB areas of oversight include:

- Debt Validation Requirements: Collectors must provide clear documentation verifying the legitimacy and accuracy of any debt before pursuing payment.

- Communication Regulations: The CFPB limits when, how often, and through which channels debt collectors can contact patients, protecting them from harassment or misleading claims.

- Dispute Handling: Agencies must pause collection activities when a patient disputes a debt and investigate thoroughly before proceeding.

- Recordkeeping and Reporting: Proper documentation of all collection activities is required to demonstrate compliance during audits or disputes.

Dental practices benefit from aligning with CFPB guidelines because it strengthens patient confidence and reduces exposure to regulatory penalties.

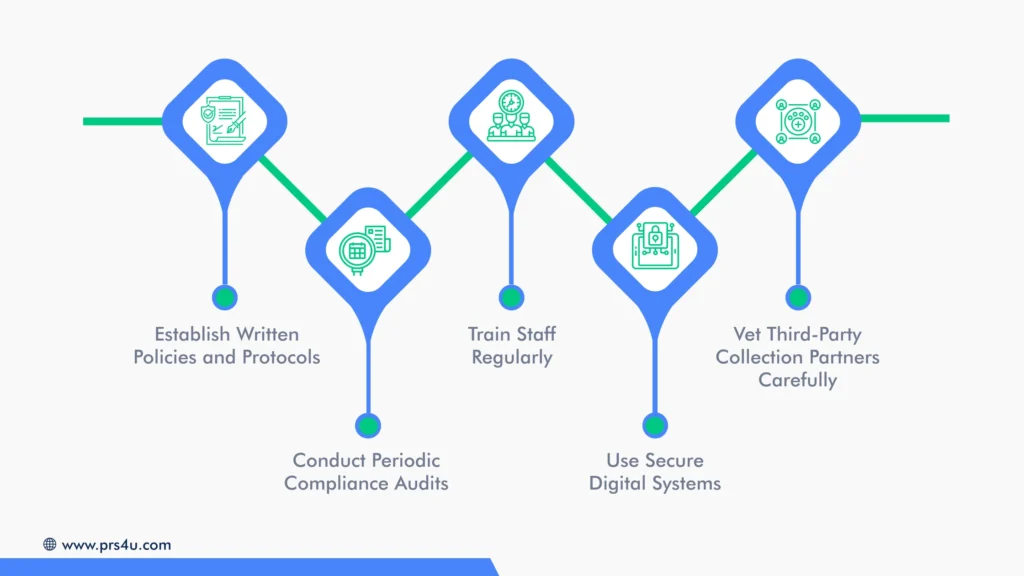

Best Practices for Maintaining Dental Debt Collection Compliance

Building a compliant and trustworthy collection process is about creating a structure that respects patient privacy while keeping your cash flow healthy. The most effective practices focus on consistency, documentation, and accountability across every step of patient communication.

Establish Written Policies and Protocols

Clear, accessible documentation of collection procedures helps ensure every staff member follows the same compliance standards. Regular reviews of these policies keep them aligned with updates from HIPAA, FDCPA, and state regulators.

Conduct Periodic Compliance Audits

Routine audits identify small issues before they escalate into fines or breaches. Evaluating data-handling processes, third-party agreements, and patient communication logs ensures ongoing alignment with legal expectations.

Train Staff Regularly

Compliance training should extend beyond onboarding. Scenario-based refreshers help employees recognize red flags, avoid risky language, and understand how to escalate potential violations.

Use Secure Digital Systems

Cloud-based billing and collection methods with encryption, access controls, and real-time monitoring reduce the risk of data mishandling. Regular system updates are important to maintaining security.

Vet Third-Party Collection Partners Carefully

Before sharing patient information, carefully consider various factors when choosing the right dental collection agency. They must maintain proper certifications, security infrastructure, and documented compliance protocols. A signed Business Associate Agreement (BAA) should always be in place.

Each of these practices builds resilience against compliance failures, reinforcing patient confidence and long-term financial integrity.

Ensure Compliance and Maximize Debt Recovery with PRS | Professional Receivable Solutions

Compliance and compassion can coexist, and Professional Receivable Solutions LLC. makes sure they do. Every account we handle reflects your practice’s integrity and commitment to patient respect. Our process safeguards patient information, maintains full HIPAA compliance, and delivers measurable results without risking your reputation or relationships.

Here’s what sets PRS4U apart:

- Proven Expertise: Over two decades of experience helping dental and healthcare providers recover millions in lost revenue.

- Exceptional Success Rates: A 95% client retention rate and 97% higher collections compared to competing agencies and attorneys.

- Diplomatic Approach: Every patient interaction is handled with empathy, professionalism, and full HIPAA compliance.

- Transparent Partnership: Clear communication, no hidden fees, and complete visibility across all collection stages.

Safeguard your compliance, reputation, and revenue all at once.

Get your free A/R analysis today and discover why practices nationwide trust PRS4U to collect with integrity and precision.