How to Know It’s Time to Hire a Dental Debt Collection Agency

Calls go unanswered, and promises to pay fade away.

This is the typical scenario for many dental practices. It starts with a few accounts that begin as “just a little overdue” and slowly turn into bad debts. Meanwhile, your staff spends more time chasing balances than serving patients.

Across the U.S., 41% of adults carry medical or dental debt, showing how common and complex the problem has become. Many patients want to pay but simply can’t, while others delay until reminders pile up. That results in a growing list of unpaid invoices that quietly drain your revenue and energy.

Knowing when to hire a dental collection agency can be the difference between steady cash flow and a financial strain that limits your ability to grow. In this blog, we will discuss the red flags, the right timing, and how to outsource collections responsibly without compromising patient trust.

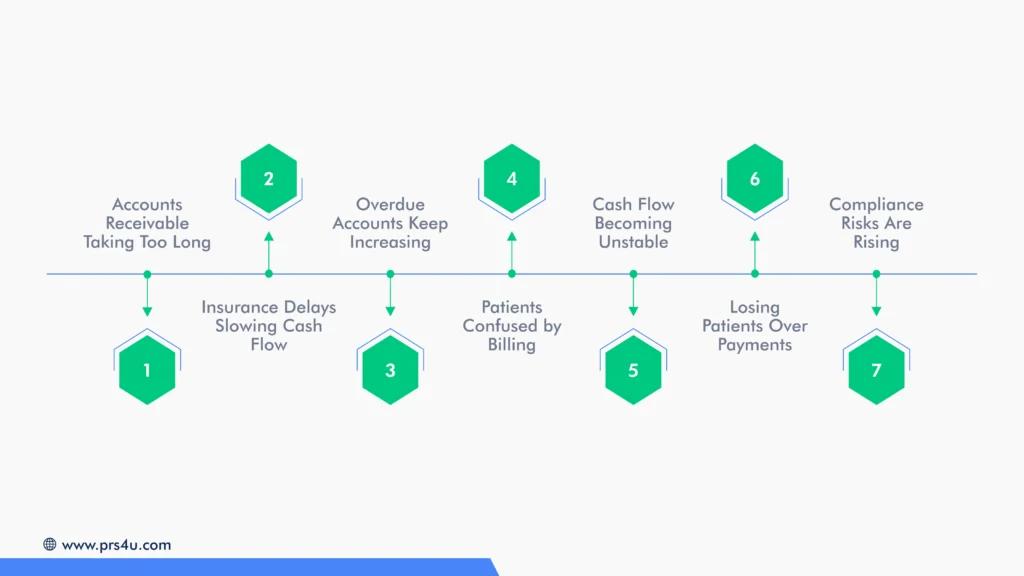

Top 7 Signs It’s Time to Hire a Dental Collection Agency

Some overdue accounts resolve after a few reminders, but others start showing patterns that signal deeper issues. Recognizing when to hire a dental collection agency in healthcare is about protecting your practice before cash flow suffers. The sooner those warning signs are spotted, the better your chances of recovering what’s owed while preserving patient goodwill.

1. Accounts Receivable Taking Too Long

If your dental practice notices that invoices are taking longer and longer to get paid, it’s a clear warning sign. Lengthy dental accounts receivable cycles can disrupt cash flow, making it difficult to cover operational costs, pay staff, or invest in new equipment.

When AR days stretch beyond your target range, routine follow-ups can consume your administrative team’s time without guaranteeing results.

Consider the following impacts of prolonged AR days:

| Impact | Description |

| Reduced Cash Flow | Limits your ability to reinvest in the practice. |

| Increased Administrative Burden | Staff spend excessive time chasing payments. |

| Strained Patient Relationships | Frequent reminders may frustrate patients. |

| Delayed Growth Opportunities | Projects or expansions may stall due to a lack of funds. |

Hiring a dental collection agency can help you regain control. Experienced agencies like Professional Receivables Solutions Medical Debt Collection can implement structured, consistent outreach strategies to recover overdue balances faster, all while maintaining patient trust.

Outsourcing these efforts allows your staff to focus on patient care rather than chasing late payments, ultimately improving both cash flow and operational efficiency.

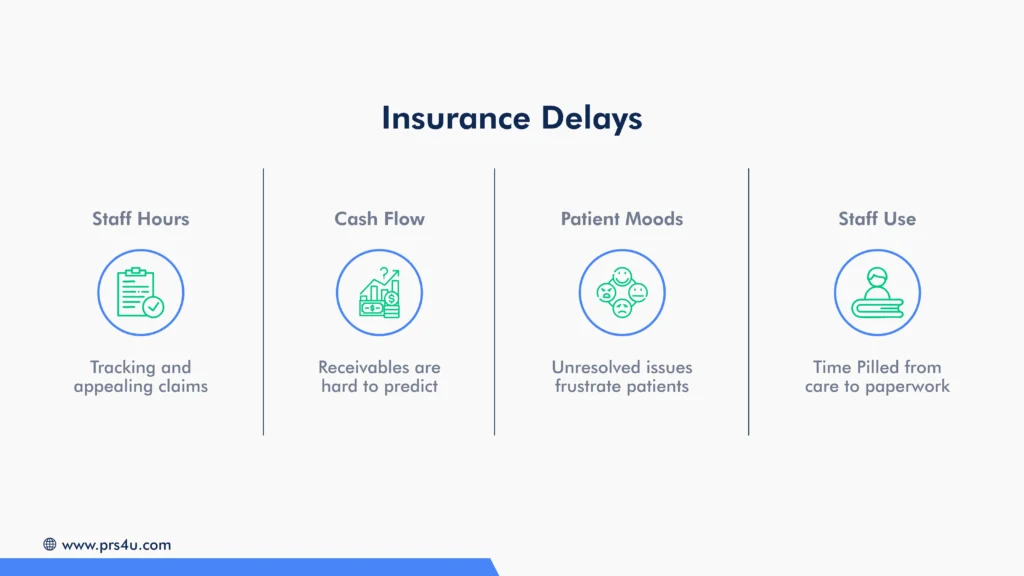

2. Insurance Delays Slowing Cash Flow

When your practice experiences frequent claim denials or insurance payment delays, it can create a bottleneck in cash flow. Staff may spend hours resolving claims, submitting appeals, or contacting insurance providers, which takes time away from patient care. Over time, these delays slow down revenue collection, increase administrative costs, and add stress on your team.

Consider the challenges posed by insurance delays:

Partnering with a dental debt collection agency helps your practice recover balances tied up in denied or delayed claims efficiently. This approach frees your team to focus on delivering care rather than chasing delayed payments.

3. Overdue Accounts Keep Increasing

A consistently high aging report is a clear indicator that unpaid balances are piling up. When a significant portion of your accounts receivable falls into the 60–90+ day category, it signals that your current collection efforts may not be effective. This can strain cash flow and increase administrative workload as staff chase overdue payments.

Indicators that your aging report is becoming a problem include:

- Rising Overdue Balances: More accounts are past due than usual.

- Longer Collection Cycles: Payments that used to arrive in 30 days now take 60–90 days.

- Repeated Follow-ups: Staff must repeatedly contact patients for the same invoices.

- Difficulty Forecasting Revenue: Unpaid accounts create uncertainty in financial planning.

Hiring a dental collection agency can help reduce aging accounts more efficiently. Professionals follow structured processes to recover overdue balances promptly, while preserving patient relationships and relieving your staff from prolonged follow-up tasks.

4. Patients Confused by Billing

Frequent questions or complaints about invoices or unexpected balances can signal that your billing process is creating friction. When patients are confused or frustrated, it can slow payments and strain staff as they try to clarify charges.

Signs that billing confusion is affecting your collections:

- Frequent Inquiries: Patients regularly call or email for clarification.

- Payment Delays: Confusion over amounts owed or insurance coverage slows payment.

- Disputes and Reversals: Incorrect or unclear bills lead to contested charges.

- Staff Frustration: Your team spends more time explaining bills than focusing on patient care.

Partnering with a dental collection agency ensures that outstanding accounts are handled professionally. These specialists can address disputes and follow up on overdue balances without damaging patient trust, helping your practice maintain smooth operations while improving cash flow.

5. Cash Flow Becoming Unstable

When unpaid accounts start impacting your ability to cover payroll, purchase supplies, or invest in new equipment, it’s a clear warning sign that collections need attention. Limited cash flow can slow growth, reduce staff morale, and make it difficult to provide high-quality care consistently.

Indicators that cash flow is being affected:

- Delayed payments to vendors or staff that disrupt operations.

- Halted investments in equipment, technology, or office improvements.

- Emergency borrowing to cover routine expenses.

- Budget strain is preventing new initiatives or marketing efforts.

Hiring a dental collection agency can help recover overdue balances efficiently, freeing up cash to stabilize operations while keeping patient relationships intact.

6. Losing Patients Over Payments

A decline in patient retention can signal that billing and collections issues are impacting your practice. Patients frustrated by unclear statements, delayed insurance reimbursements, or repeated follow-ups may decide to take their care elsewhere.

- Cancellations or No-Shows: Patients skip appointments after receiving confusing bills or multiple reminders.

- Frequent Billing Inquiries: Staff spend excessive time answering patient questions about statements or balances.

- Loss of Loyal Patients: Long-term patients gradually stop returning due to repeated billing frustrations.

- Negative Feedback: Online reviews or comments mention dissatisfaction with billing or collection practices.

Addressing these issues through a dental collection agency can help safeguard both revenue and patient trust.

7. Compliance Risks Are Rising

Failing to stay on top of healthcare regulations can expose your practice to fines, penalties, and reputational damage. A dental collection agency helps ensure that collections follow all relevant rules.

- HIPAA Violations: Mishandling patient information during collections can breach privacy regulations.

- Insurance Compliance: Errors in follow-up with insurance claims may result in denied reimbursements or audits.

- State & Federal Rules: Collection practices must align with both local and federal laws to avoid legal repercussions.

- Documentation Requirements: Accurate records of communication and actions taken protect your practice in case of disputes.

Outsourcing to experts reduces your risk while keeping collections professional and compliant. Knowing when to hire a dental collection agency can keep your cash flowing.

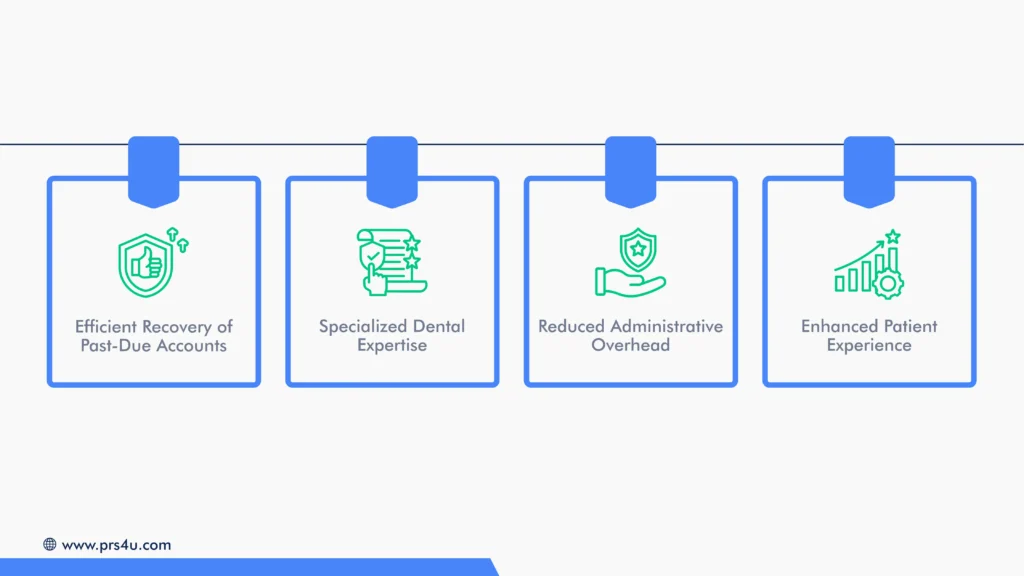

How Dental Debt Collection Agency Supports Your Practice

Outsourcing collections protects your practice and patients. A professional dental debt collection agency combines industry knowledge, efficient processes, and patient-sensitive approaches to keep your practice running smoothly while improving cash flow.

- Efficient Recovery of Past-Due Accounts: Focused strategies and persistent follow-ups help resolve outstanding balances faster.

- Specialized Dental Expertise: Knowledge of dental billing, insurance procedures, and regulatory requirements ensures accuracy and compliance.

- Reduced Administrative Overhead: Free up staff time and minimize errors by letting specialists manage collections.

- Enhanced Patient Experience: Respectful, empathetic communication preserves patient trust while addressing overdue balances.

How to Choose the Right Dental Collection Agency

Now that you know when to hire a dental collection agency, it’s time to choose the right one. Selecting the right dental collection partner can make a huge difference in maintaining cash flow and patient trust. Not all agencies operate the same way, so it’s essential to evaluate their practices, experience, and approach before committing.

- Verify Licensing and Compliance: Confirm the agency meets state licensing requirements and adheres to consumer protection laws as well as medical collection regulations.

- Understand Pricing Models: Compare flat fees, contingency-based fees, or per-account pricing to ensure transparency and alignment with your budget.

- Review Success Metrics: Ask for recovery rates, timelines, and case studies to assess effectiveness.

- Assess Communication Style: Ensure the agency interacts respectfully with patients, maintaining a professional and empathetic tone.

- Check Technology Support: Look for resources that allow real-time tracking, reporting, and visibility into your accounts.

Choosing the right dental collection agency is about finding a partner who protects your reputation, enhances patient experience, and supports your practice’s financial health. Taking the time to evaluate these factors upfront can preserve relationships and ensure more predictable cash flow.

Maximize Collections Without Hurting Patient Trust With PRS | Professional Receivable Solutions

Watch out for signs about when to hire a dental collection agency and take the required action. Partnering with Professional Receivable Solutions LLC. means entrusting your overdue accounts to experts who understand the unique challenges of dental collections. Our approach balances efficiency, compliance, and patient respect, helping practices recover more revenue without straining relationships.

- Higher Recovery Rates: Our proven, innovative collection process delivers faster, more consistent recoveries for your past-due accounts.

- Save Time & Resources: Free your staff from chasing payments and reduce time spent mailing statements and making unanswered calls.

- Collection Control: Submit, pause, or suspend accounts based on communication with patients or internal staff.

- Better Results, Sooner: Accounts become harder to collect over time; our Stage One process helps recover revenue early.

- Lower Cost Pricing: Flat-fee Stage One System (averaging $10 per account).

Get Started Today! Focus on patient care while we handle your collections efficiently and responsibly.

Request a free A/R analysis today to regain control of your overdue accounts and turn outstanding payments into reliable cash flow.