How to Improve Cash Flow in Your Dental Practice with Strategic Debt Collection

Maintaining consistent revenue in a dental practice is challenging, especially when patient payments are delayed beyond the treatment date. While many practices excel in clinical care, receivables management often falls by the wayside. According to industry benchmarks, the average dental practice has approximately 18% of its accounts receivable over 90 days past due. This delay in payments can lead to erratic cash flow, increased administrative burdens, and mounting unpaid balances.

Staff members spend valuable time chasing debts, diverting their focus from patient care and other critical tasks. This affects productivity while also straining the practice’s financial health. Implementing strategic debt collection practices can alleviate these challenges.

By partnering with a specialized dental debt collection agency, practices can recover outstanding fees efficiently without jeopardizing patient relationships. This approach helps establish a sustainable financial rhythm, ensuring that revenue aligns more closely with service delivery.

Is Hidden Administrative Work Hurting Your Dental Practice’s Efficiency?

Running a dental practice involves far more than clinical care. Between scheduling appointments, handling compliance paperwork, verifying insurance, and managing billing, staff are constantly juggling multiple priorities. Adding the task of following up on overdue payments only compounds the challenge, often stretching teams thin and creating room for errors.

Challenges faced by internal teams:

- Reduced Staff Productivity: Time spent chasing payments takes away from patient interaction and essential operational tasks.

- Inconsistent Messaging to Patients: Overloaded staff may provide unclear or conflicting information about balances, frustrating patients.

- Risk of Delayed Revenue: Slow follow-ups or missed invoices directly impact cash flow and financial planning.

- Higher Likelihood of Errors: Multitasking increases the chance of billing mistakes, misapplied payments, or lost invoices.

- Staff Burnout and Turnover: Constant administrative pressure can lower morale and increase turnover, affecting continuity of care.

Outsourcing collections allows internal teams to focus on patient care and smooth practice operations while ensuring revenue recovery continues efficiently.

What is the Difference Between Aggressive and Strategic Collection?

Recovering unpaid balances doesn’t have to come at the cost of patient relationships. Many practices mistakenly equate collections with pressure tactics, which can alienate patients and even reduce future appointments.

Strategic collection of unpaid invoices, on the other hand, emphasizes professionalism, clarity, and tact. It balances persistence with empathy, ensuring patients understand their obligations without feeling threatened or embarrassed.

Aggressive methods often focus solely on speed of recovery, whereas strategic approaches aim for timely payments while preserving trust and goodwill, which supports long-term financial health and patient loyalty.

| Aspect | Aggressive Collection | Strategic Collection |

| Communication Style | Harsh, intimidating, or repetitive calls and messages | Professional, clear, empathetic, and patient-friendly |

| Timing | Pushes for immediate payment without context | Follows structured timelines with reminders and grace periods |

| Focus | Only on immediate cash recovery | On payment recovery and maintaining long-term patient relationships |

| Flexibility | Rarely offers payment options | Offers installment plans, deferred payments, and hardship accommodations |

| Outcome | Risk of complaints, patient loss, and reputational damage | Higher likelihood of resolution, patient satisfaction, and predictable revenue |

This approach ensures that dental practices recover outstanding fees efficiently while avoiding the pitfalls of aggressive collection tactics, directly supporting how to improve dental cash flow without compromising patient trust.

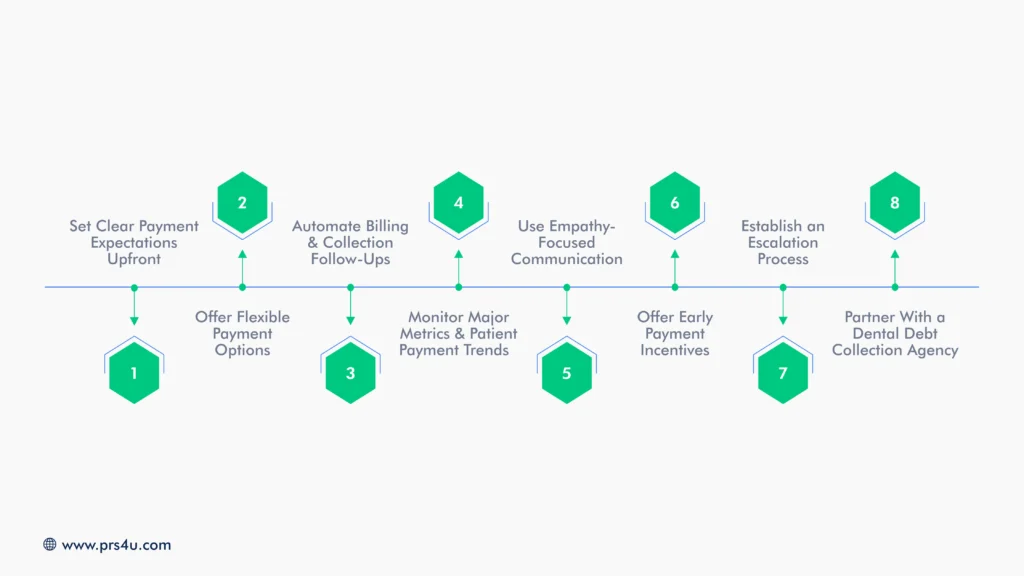

8 Ways to Improve Cash Flow for Dental Practice with Strategic Debt Collection

Maintaining a steady cash flow is one of the biggest challenges for dental practices. Even when appointments are full and clinical care is top-notch, delayed payments can create unpredictable revenue gaps that affect staffing, equipment purchases, and day-to-day operations. Strategic debt collection offers a practical solution.

1. Set Clear Payment Expectations Upfront

One of the most effective ways to improve dental cash flow is to establish payment expectations at the very beginning of the patient relationship. When patients know exactly what they will owe and when, there’s less confusion, fewer disputes, and faster payments.

Clarity starts before treatment: make sure patients understand their financial responsibility, how insurance applies, and what options exist for settling balances.

Practical steps include:

- Transparent Estimates: Provide itemized treatment plans that outline costs clearly.

- Discuss Payment Policies: Explain when payments are due, accepted methods, and potential fees for late payment.

- Consent & Acknowledgment: Ensure patients acknowledge understanding of their financial obligation before treatment.

- Written Agreements: Document payment terms to avoid disputes later.

By setting expectations upfront, you reduce uncertainty, encourage timely payments, and strengthen trust, laying the foundation for smoother cash flow and fewer collection headaches.

2. Offer Flexible Payment Options

Patients’ financial situations vary, and not every individual can pay their dental bills in full immediately. Providing flexible payment solutions encourages timely settlements while maintaining goodwill, which ultimately improves dental cash flow.

Strategic debt collection doesn’t pressure patients; it makes repayment feasible and structured, reducing the risk of accounts going past due.

Options to consider include:

- Installment Plans: Allow patients to pay balances over several months in manageable amounts.

- Deferred Payments: Offer a grace period for those recovering from major procedures or financial hardships.

- Sliding Scale or Income-Based Plans: Adjust payments according to the patient’s financial capacity.

- Interest-Free Options: Avoid adding extra cost to encourage compliance and reduce stress.

Offering patients budget-friendly options can reduce late payments, maintain active accounts, and consistently improve dental cash flow.

3. Automate Billing & Collection Follow-Ups

Manual follow-ups can be time-consuming, inconsistent, and prone to error. Automation streamlines the process, sending timely reminders and invoices without burdening staff. This ensures patients are consistently aware of their balances and encourages faster payments, directly impacting how to improve dental cash flow.

Automation benefits include:

- Scheduled Reminders: Emails, texts, or portal notifications alert patients of upcoming or overdue payments.

- Recurring Billing: Automatically charge payment plans on set dates to reduce missed payments.

- Centralized Tracking: Monitor all invoices and payment attempts in one system for clear visibility.

- Reduced Administrative Errors: Automated workflows minimize mistakes that can delay payments.

Integrating automation with strategic debt collection practices ensures that accounts stay current, reduces staff workload, and creates a predictable cash flow for the practice.

4. Monitor Major Metrics & Patient Payment Trends

Tracking your practice’s financial health is essential for maintaining stability and planning effectively. By keeping a close eye on accounts receivable, overdue invoices, and payment timelines, you gain actionable insights that help reduce bottlenecks and anticipate cash flow challenges.

Regularly reviewing patient payment trends allows you to identify patterns, such as frequent delays or seasonal fluctuations, and adjust your collection approach accordingly.

Consistently monitoring these metrics is a practical step toward knowing how to improve dental cash flow, ensuring predictable revenue and smoother financial management.

5. Use Empathy-Focused Communication

The way you discuss unpaid balances can make a huge difference in patient cooperation and satisfaction. Using empathy-focused communication preserves trust and ensures smoother collections, critical for knowing how to improve dental cash flow.

- Personalized Follow-Ups: Reference prior communications and patient history to show attention and care.

- Supportive Scripts: Focus on understanding and collaboration rather than pressure or threats.

- Payment Guidance: Offer clear explanations of payment options that fit the patient’s financial situation.

- Active Listening: Allow patients to voice concerns, which fosters goodwill and encourages timely repayment.

By integrating empathy into your collection process, you strengthen patient relationships while recovering funds efficiently.

6. Offer Early Payment Incentives

Encouraging patients to pay sooner can significantly smooth revenue flow and help improve dental cash flow. Small incentives create motivation while maintaining goodwill. You can offer:

- Discounts for Prompt Payment: Provide a percentage off the total bill if paid within a set timeframe.

- Priority Scheduling or Services: Reward early payers with faster appointment options or value-added perks.

- Loyalty Rewards: Accumulate points or benefits for consistently timely payments.

- Clear Communication: Ensure patients understand the incentive program upfront to maximize participation.

Structured incentives create a win-win: patients feel appreciated, and your practice secures steadier revenue.

7. Establish an Escalation Process

Having a clear, tiered approach to overdue accounts ensures efficiency, protects relationships, and improves dental cash flow. Each step is structured to increase recovery efforts without becoming confrontational.

Here’s how it works:

- Initial Reminder: Gentle, polite notifications sent shortly after the due date to prompt payment.

- Follow-Up Communication: Phone calls or emails emphasizing clarity and the importance of timely settlement.

- Formal Notice: Written correspondence outlining next steps if payment is not received.

- Professional Assistance: Engage a dental debt collection partner for persistent accounts, ensuring compliance and patient respect.

A structured escalation process reduces administrative guesswork and secures faster payment while preserving patient trust. It is an important strategy to know how to improve cash flow in your dental practice.

8. Partner With a Dental Debt Collection Agency

Outsourcing overdue accounts to a specialized agency can significantly improve dental cash flow while maintaining positive patient relationships. Agencies trained in dental billing and collections handle the complexities of insurance, patient follow-ups, and compliance, freeing your staff to focus on care rather than chasing payments.

Before selecting a partner, it’s essential to understand the major factors to consider when choosing among different dental collection agencies, including compliance standards, communication style, recovery rates, and transparency in pricing. Evaluating these factors ensures your chosen partner aligns with your practice’s values and maintains professionalism with patients.

Working with a professional partner ensures that revenue recovery is handled efficiently, communication with patients remains respectful, and your practice can maintain financial predictability.

This approach helps reduce administrative burdens, prevents accounts from aging unnecessarily, and allows your team to dedicate their time to patient care and practice growth.

Start Recovering Overdue Payments Today With PRS | Professional Receivable Solutions

Partnering with Professional Receivable Solutions LLC. gives your dental practice a professional, efficient, and patient-friendly approach to recovering overdue accounts. Here’s how our services make a difference:

- Higher Recovery Rates: Our proven collection process recovers more revenue quickly, helping your practice achieve a steadier cash flow.

- Save Staff Time: Reduce administrative burden by letting our team handle follow-ups, statements, and communications

- Flexible Collection Control: Submit, pause, or suspend accounts based on real-time communication with patients.

- Better Financial Outcomes: Early-stage collection strategies capture revenue before accounts become harder to recover.

Take the first step toward consistent cash flow, less staff stress, and stronger patient relationships. Get your free A/R analysis today and see how we can support your dental practice.